RAKislamic Savings Account

RAKislamic now offers you the Sharia compliant Savings Account that conveniently helps you save for your future needs, combined with the award-winning service from RAKBANK.

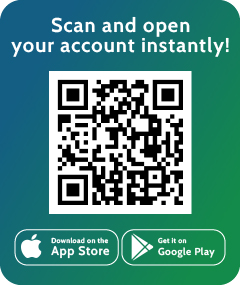

Simply download RAKBANK APP and open your RAKislamic Savings Account digitally in minutes, anywhere anytime.

Earn profit and save

The Savings Account is based on the Islamic principle of ‘Mudaraba’ which means you can earn profit on your savings. The profit is declared and credited to your account on a quarterly basis.

Convenience

Your Savings Account can be opened in multiple currencies. The low minimum average balance makes opening and maintaining your Savings Account easy and convenient. You also get Monthly Statements / E-Statements.

A minimum average monthly balance of AED 3,000 is required to maintain a RAKBANK Savings Account. If this is not maintained, the following fees in the currency of the Savings Account will be incurred:

Foreign Currency Services

| Currency | % p.a. |

|---|---|

| JPY | -0.60 |

| Euro | 0 |

| CHF | 0 |

Accounts in these currencies are based on Qard Hassan and not part of Mudaraba

Foreign currency services is accrued daily and applied monthly.

Note: Above rates effective 1st July, 2020.

Banking anytime and anywhere

Our free online, SMS, phone and mobile banking services give you simple and secure banking on the go:

1. Click and Easy banking with Online Banking (register now at www.rakbank.ae)

2. RAKdirect Number 600 54 0044

3. SMS alerts through your mobile phone

4. Mobile banking

Risks & Limitations

- Debit Card is issued only for AED denominated Account and not for other currencies.

- Debit Cards are only issued to account holders over the age of 18 years.

- Debit Card is required for accessing Digital Banking facilities, and hence, for other currencies, you will not be able to get access to Digital Banking unless you have a transactional account that provides you with a Debit card.

- Savings account belonging to minors will be administrated by the parent or guardian.

Customer Obligations

You are required to:

- Maintain a minimum average monthly balance of AED 3,000, and If this is not maintained, the following fees in the currency of the Savings Account will be incurred:

-

Currency Minimum Average Monthly Balance Fee AED 3,000 25 AED USD 3,000** 25 AED GBP 3,000** 25 AED Euro N/A N/A CHF N/A N/A JPY N/A N/A prevnext - Review all other terms & conditions set out in the application form in detail;

- Regularly check our website (www.rakbank.ae) for updates;

- Notify the Bank in writing if there is a change in your employment or income details, contact details, residential status, identification details, financial details or any other material information as declared in the application form; and

- Always safeguard sensitive banking details such as a/c number, cheque book, Debit Card, login ID, passwords, pin number etc.

Key Terms & Conditions

- No minimum balance is required for the first 3 months on Saving Accounts.

- For Euro, CHF & JPY currencies, FCY maintenance charges are accrued daily and applied monthly

- A salary transfer letter is required as additional documentation for customers opening the account for salary transfer purpose

- The Bank may amend the features, fees, charges, terms & conditions of the Account on 60 days’ notice to you in advance.

- The Bank may amend the profit rates for the Account on 30 days’ notice to you in advance.

- If the Account is not used for a period of 1 year, it will be designated as inactive and you will not be able to transact unless activated again.

- If the Account balance is not sufficient to settle outstanding dues, these will be recovered as and when the Account is funded or alternatively from any other account held by the customer with the Bank.

- In line with the UAE’s Value Added Tax (VAT) implementation from 1st January 2018, VAT at the rate of 5% will be levied on RAKBANK’s fees and charges specified herein, wherever applicable and as per UAE law.

Warnings:

- Foreign currency denominated accounts may incur foreign currency services. Applicable foreign currency services will be debited from the available balance for customers availing such Foreign Currency Services. This may cause reducing balance even without customer induced withdrawals.

- The Bank may close the Account if KYC or identification documents are not updated regularly, or if required as internal policies or upon request from regulatory/judiciary entities.