Everest Pro Series

A secure investment policy that pays out the highest value

Everest Pro is an innovative new single premium endowment product underwritten by RAKINSURANCE and is available for one-off investments for a limited period only. The Product is exclusively available for RAKBANK customers.

The plan pays a guaranteed benefit upon maturity or in case of premature death. It also offers participation in the development of a pre-defined capital market index. This gives you the potential for higher returns while the minimum guaranteed benefit limits the risks normally associated with direct investment in the stock market.

The lump sum payment at maturity or death may be higher than the guaranteed benefit due to positive performance of the pre-defined capital market index.

There are 2 available plan options:

Highest NAV [Look-Back option]

This Plan option increases the lump sum payment at maturity based on the highest semi-annual performance of the pre-defined risk controlled index i.e. Systematix® BEST 10% RC USD Index.

Higher Participation [Without Look-Back option]

This Plan option also offers higher participation rate in the performance of the Systematix® BEST 10% RC USD Index. It may increase the lump sum payment at maturity based on the performance of the pre-defined index at the end of the policy term.

Benefits

Equivalent to the higher of:

- X% of the single premium paid; and

- The Policy value

Where X% is as follows:

Minimum Maturity benefit (X%)

| Policy Term | With Highest NAV | With Higher Participation |

|---|---|---|

| 3 years | 100% | 101% |

| 5 years | 100% | 103% |

| 7 years | 100% | 105% |

Death benefit

If the life assured dies during the plan duration, the higher of the following will be paid in lump sum:

- 100% of the single premium paid; and

- The policy value on the next valuation day following the date death notification is received

Eligibility and Criteria

| Entry Age of life assured | Minimum: 18, Maximum: 65 (age next birthday) |

|---|---|

| Currency | USD only |

| Coverage Period | Up to age 72 |

| Underwriting |

Financial underwriting will be applicable No medical underwriting is required |

| Minimum Single Premium | USD 5,000 |

| Maximum Single Premium | USD 1,000,000 and above (Subject to availability and approval) |

| Premium Allocation Rate | 100% of the single premium will be allocated |

Click here to download Product Brochure

Click here to download Frequently Asked Questions (FAQs)The Index

Systematix® BEST 10% RC USD Index: Objective and Overview

The Index Owner is Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München, Germany («Munich Re»). The Index has been developed by Munich Re for exclusive use by Ras Al Khaimah National Insurance Company (P.S.C.) (‘RAKINSURANCE’).

The objective of the Index is to achieve capital growth in the mid to long term by maintaining exposure to equity and bond markets using a rule-based investment strategy.

The index seeks to capitalize on price momentum, where it is assumed that the equity markets which produced positive returns in the past may continue producing positive returns in the future and vice versa. So, the equity markets whose prices have shown an increasing trend will generally be bought while the equity markets whose prices have shown a decreasing trend will generally be held neutral.

The index manages the investment exposure to the various markets as a function of realized volatilities, which allows each market to contribute an approximately equal amount of risk to the index. Markets which have exhibited greater price fluctuations in the past relative to other markets will have lower weightage in the index and vice versa.

How does it work?

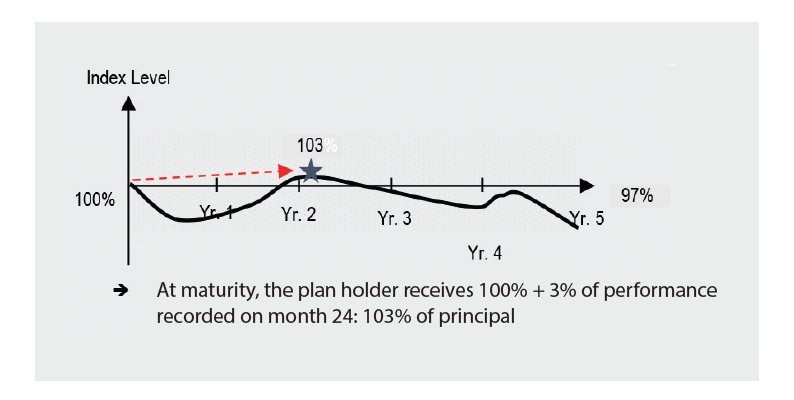

Lock-in feature to protect from market falls

Scenario 1:

Buoyant markets with upside potential

Scenario 2:

Slightly bearish to flat market

Scenario 3:

Bearish market

Note: All illustrations in this marketing material are not drawn to scale. Furthermore, it assumes 100% participation rate. The figures shown are hypothetical and are for illustration purposes only.

Disclaimer

DISCLAIMER: Everest Pro Series (“Policy”) is underwritten and issued by Ras Al Khaimah National Insurance Company (“RAKINSURANCE”). The Policy is exclusively available for RAKBANK customers and is subject to their approval. Terms and Conditions of the Insurance Policy shall apply at all times. RAKBANK is neither responsible for, nor guarantees or warrants the quality, fitness for purpose, suitability of the Insurance Policy being offered by RAKINSURANCE and does not accept any liability and will not be liable for any loss or damage arising directly or indirectly to the customer taking the Insurance Policy.

Apple Pay

Apple Pay