What's the buzz! Keep up with the latest news from RAKBANK.

RAKBANK inspires future generation to protect the UAE’s environmental landscape

٠٨/٠٦/٢٠١٥

RAKBANK today hosted a workshop with leading conservationist and vet, Dr Anne-Lise Chaber and youth Emirati environmentalist Ameera Al Haranki, ahead of a Dubai British School conservation expedition to South Africa taking place this summer. The expedition team and 40 Year 10 GCSE geographers attended the RAKBANK workshop, promoting conservation awareness and sustainability both at home, in South Africa and worldwide. The two spokespeople were Dr Anne-Lise Chaber, from The Wildlife Organisation, who heads up the RAKBANK funded Wildlife Project, and environmental role model, Ameera Al Haranki, giving insights from her RAKBANK sponsored two week environmental expedition to the Antarctic earlier this year.

Financed by their own fundraising, four sixth form student, studying A-Levels, and a Geography teacher will be working with local communities and the South African Government to manage and conserve the country’s wildlife. The project will take place in one of the largest game reserves in Africa, the Kruger National Park, and Sodwana Bay, a narrow strip of sand dunes located on the east coast of South Africa.

Through this workshop RAKBANK aims to inspire not only the geographers participating in the expedition and their peer group but the next generation to get involved with environmental projects and preserve the UAE’s landscape.

RAKBANK Lifts Foreign Ownership Limit

٠٧/٠٦/٢٠١٤

RAKBANK is pleased to announce that it received ministerial approval to lift its foreign ownership level to 40% following the decision to do so at the Extraordinary General Meeting held on 8th May 2014. The new limit has been adjusted by Abu Dhabi Securities Exchange (ADX) last Thursday 5 June.

Commenting on the limit increase, Peter England, RAKBANK’s CEO, said that the Bank had been running very close to the old 20% limit for some months now. Foreign interest has picked up very strongly, he explained, as a result of the UAE's inclusion in the MSCI Emerging markets index as well as the Bank’s active engagement with foreign investors in recent months.

“We most probably would have seen foreign trades being rejected in the near future had the limit not been increased,” said England. “Investors are very keen to hold RAKBANK stock due to its valuations considering that the Bank has one of the highest ROA, ROE, and Tier 1 Capital ratio of any bank in the region.”

About RAKBANK

RAKBANK, also known as the National Bank of Ras Al-Khaimah, is a leading retail and small to medium business bank in the UAE, serving over 700,000 customers. Founded in 1976, the Bank is one of the country’s oldest local financial institutions and today one of its fastest growing and most dynamic banks. According to The Banker's Top 100 Bank Rankings for 2013, RAKBANK is the 1st in the Arab World by Return on Assets and 5th in the Arab World by Return on Capital.

RAKBANK offers a wide range of personal and business banking services, as well as Islamic Banking solutions via RAKBANK AMAL, throughout its 34 branches, and its Telephone, Online, and Mobile banking channels.

RAKBANK Wins Best Mobile Banking Initiative and Best SME Bank in the Middle East for 2014

٠١/٠٦/٢٠١٥

RAKBANK was awarded the Best Mobile Banking Initiative and Best SME Bank in the Middle East for MobileCash, its cardless ATM withdrawal and RAKFinance, its small business lending offering.

Using MobileCash, customers can send and withdraw money from the ATM without the need for a debit card. By the end of 2014, monthly transactions grew by almost 200%, with the total value of withdrawals reaching upward of AED 30 million ($8.2m)

The Operating Profit of RAKFinance grew 22% in 2014 while its traditional Business Banking loan book more than doubled during the year.

Dubai, May xx 2015 — RAKBANK won the award for the Best Mobile Banking Initiative and Best SME Bank in the Middle East for the year 2014 at The Asian Banker’s 2nd Annual Middle East and Africa Awards Ceremony. The ceremony was held at the Ritz Carlton, DIFC, Dubai on May 27th 2015.

RAKBANK launched MobileCash in mid-2014, its cardless money withdrawal service. Using MobileCash, customers can send money to a beneficiary who can withdraw it from an ATM without the need for a debit card. Customers can simply log into their mobile banking application and select the MobileCash option for self or beneficiary followed by the amount they wish to send. The beneficiary can then withdraw cash from the nearest RAKBANK ATM using only the one-time pin that is generated and sent through SMS.

Keeping customer awareness and engagement at the forefront, the Bank ran an extensive advertising campaign, resulting in an exponential increase in the number of transactions month-on-month since the launch of the service. In the first few months of operations, monthly transactions grew by almost 200%, with the total value of withdrawals exceeding AED 30 million ($8.2m).

On the other hand, the SME segment’s operating profit grew 22% in 2014 on the back of strong growth in RAKFinance (the Bank’s collateral-free lending product) as well as significant growth in the Bank’s traditional Trade Finance and Working Capital lines. The SME business contributes 30% to the total revenue of the bank, offering customers collateral free business loans and innovative trade solutions. The bank introduced an asset based financing product in 2014, further increasing the bank market share in the SME space, while helping clients meet both long and short term financial need of their businesses.

Award-winning banks and vendors attended the gala event that recognised their efforts in bringing superior products and services to their customers. The Asian Banker’s Middle East and Africa Awards are acknowledged by the financial services industry as the highest possible accolade available to professionals and banks in the industry. Over 100 institutions from the Middle East and Africa were evaluated across 30 different countries. A stringent three-month evaluation process based on a balanced and transparent scorecard has been used to determine the winners.

RAKBANK Acquires 79.23% of RAK Insurance

United Arab Emirates, 28 May 2015: RAKBANK today announced the acquisition of 79.23% stake Ras Al Khaimah National Insurance Company P.S.C. (RAK Insurance) following the purchase of a total of 87,154,981 shares at AED 3.64 per share through a tender offer. The acquisition enables RAKBANK to become the largest shareholder in the insurance provider and is in line with the Bank’s strategy to become a broad-based financial services company.

H.E. Mohammad Omran Alshamsi, RAKBANK Chairman, commented: “The acquisition is consistent with the Bank’s key strategic objective of strengthening market share and I am confident that this acquisition will deliver long-term value to all stakeholders.”

Peter England, RAKBANK CEO, said: “RAK Insurance is a successful and well reputed insurance provider and we look forward to growing our collective businesses in a very close partnership and to jointly develop a range of insurance products over time. We see a tremendous opportunity for growth in the Bank’s business by diversifying into complementary industries such as insurance that enhance revenue and market share and ensure that customers enjoy a more wholesome experience.”

Founded in 1974, RAK Insurance is a successful insurance provider listed on the Abu Dhabi Securities Exchange (ADX) and has a full license to issue conventional general and life policies.

Andrew Smith, RAK Insurance CEO, said: “I am delighted that we have been able to partner with RAKBANK through a share acquisition. Developing the bancassurance channel, RAK Insurance will be able to further strengthen its client’s relations and help provide the bank with unique and innovative products and services. This is an exciting opportunity for both parties and I look forward to continued success.”

With a total capital ratio of 24.2% by end of March 31 2015, RAKBANK funded the entire acquisition through existing resources. Whilst RAK Insurance will become the Bank’s preferred insurance partner, RAKBANK will continue to bring to its customers a range of insurance products from other providers as per its current arrangements to ensure that customers have choice from a wide range of products to suit their needs. The Bank has 35 branches and over 200 ATMs throughout the UAE, as well as Telephone, Online, and Mobile banking solutions.

RAKBANK Launches RAKGoldInvest

١٩/٠٥/٢٠١٥

Gold is often perceived as an investment haven due to its enduring ability to retain its value and mitigate the impact of inflation. It is the world’s oldest international currency and has proved to be one of the leading asset classes of the 21st century. According to a study by Rhodes Precious Metals Consultancy commissioned by RAKBANK, gold has produced an average return of almost 13% per annum since 2001, easily outperforming US equities which grew at an annual average of just 6% over the same period. In the UAE, the size of Dubai’s physical gold market has grown from just under $5 billion in 2002 to over $55 billion in 2014, with the emirate acting as the logistical bridge connecting the world’s major physical gold markets.

To provide customers with the opportunity to diversify their investment portfolio, RAKBANK launched RAKGoldInvest, an investment tool that allows High Net Worth customers to invest in gold electronically whilst saving them the hassle of storing and moving the gold. Customers can buy, sell, or hold their investments 24/7 via an online trading platform on the Bank’s corporate website, and can convert their RAKGoldInvest holdings to physical gold bars at any time.

This is the second gold-themed product launched by RAKBANK in 2015. In January, RAKBANK partnered with Kalyan Jewellers to launch a co-branded Credit Card. The RAKBANK KALYAN JEWELLERS MasterCard Credit Card, which is accepted globally for purchases and cash withdrawals, offers ‘Goldback’ loyalty points that are earned at a rate of up to 7% and can be redeemed at any Kalyan Jewellers outlets in the UAE in the form of jewellery. To ensure customer convenience, the card also offers a 0% easy payment plan on diamond and gold jewellery purchases.

“RAKBANK recognizes the strong appeal of gold investments especially among Asian communities who still largely consider them to be the ultimate store of value even with the introduction of modern financial instruments and asset classes,” said Peter England, RAKBANK CEO. In fact, demand for gold was virtually exclusive to Asia before the Global Financial Crisis in 2008 but since then there’s been a significant move into gold worldwide as an alternative hard asset to traditional paper investments such as equities and bonds.*

Gold’s purchasing power grew by 10.72% in USD terms between 2001 and 2014 compared to a 2.27% increase in US Consumer Prices. The proof of gold’s enduring ability to retain its value and mitigate the impact of inflation is also highlighted by an increase of more than 43% in the yellow metal’s purchasing power since 2001 compared to that of crude oil.*

“With the launch of RAKGoldInvest and the Kalyan co-branded credit card, RAKBANK offers flexible, convenient, and simple gold-themed products that aim to diversify customers’ investment portfolio,” added England.

Existing RAKBANK customers can apply for RAKGoldInvest online through the Bank’s Online Banking platform while new bank customers are invited to visit one of the bank’s 35 branches in the UAE. To learn more about RAKGoldInvest, kindly get in touch with RAKBANK on 04 2130000.

RAKBANK Wins ‘Best Digital Bank in the Middle East’

١٢/٠٥/٢٠١٥

RAKBANK Announces AED 362.2 million Net Profit for the First Quarter of 2015

٢٢/٠٤/٢٠١٥

RAKBANK today announced a net profit of AED 362.2 million for the three months ended 31 March 2015. Gross loans and advances grew by 15.8% year-on-year and stood at AED 26.7 billion by the end of the quarter.

The 8.3% increase in profit over same period last year reflects a year-on-year improvement in operating income and improved expense ratios. Total Operating Income for the three months ended March 2015 increased by 13.1% year-on-year to AED 932.3 million due to a rise in net interest income. Non-interest income was up by 7.2% to AED 198.8 million compared to the same period last year mainly due to an increase of 11.4% in fees and commission income.

During the first quarter the Bank continued to invest in its distribution network, product development, and electronic solutions. In addition to opening a new branch in Al Ras area and launching the KALYAN JEWELLERS co-branded MasterCard credit card, RAKBANK was recently recognized during the G-Summit 2015 as one of the very few banks in the world to provide authenticated web chat service to customers on its corporate website and its Online Banking platform. As a result of these investments and a rise in employment costs to support business growth, operating expenses increased by 4.8% year-on-year to AED 377.0 million by the end of the first three months of 2015. Nevertheless, Cost-to-Income ratio dropped to 40.4% as at 31 March 2015 from 43.6% as at 31 March 2014.

“Our first quarter financial results reflect stable earnings, healthy liquidity, and a strong capital base,” said Peter England, RAKBANK CEO. “The key contributing factor is growth in gross loans and advances, which were up by AED 863.9 million year-to-date as a result of strong signs of growth during the quarter across most business units especially RAKFinance, Auto Loans, and Business Banking. Traditional working capital and trade loans to the SME and Commercial Banking segment grew by around 130% year-on-year and our Trade Finance portfolio surpassed AED 2 billion.”

The total impairment charge for the three months increased by AED 62.7 million year-on-year to AED 193.1 million as the provision coverage ratio closed at 84.6%. “This rise is largely due to an increase in provisions in Personal and RAKFinance loans, the overall growth in our loan book, and the Bank’s commitment to a long-term sustainable performance as we continue to take further precautionary provisions on our restructured book. That being said, non-performing loans (NPL) and net credit loss (NCL) remain very reasonable given the fact that we are largely an unsecured lender,” explained England. As of 31 March 2015, NPL stood at 2.7% of the gross loan portfolio and the annualized NCL to average loans and advances closed at 2.98%.

Total assets grew by 2.5 billion year to date as a result of loans and advances and deposits with other banks. This includes the un-deployed funds from the Bank’s own Euro Medium Term Note (EMTN) which raised a further USD 300 million in February 2015 by re-opening the June 2019 bond under the Bank’s USD 1 billion EMTN programme. In addition to the ordinary growth in assets, the Bank received AED 3.7 billion in funds from a Business Banking customer on 31 March 2015, which was parked with other banks on an overnight basis. As a result, total assets stood at AED 41.0 billion by the end of the quarter.

Customer deposits were up by AED 1.5 billion year to date on the back of an increase in current and saving accounts as well as Islamic banking deposits, which grew by 11.5% to AED 2.9 billion. Taking into account the AED 3.7 billion funds received from a Business Banking customer on 31 March 2015, total deposits stood at AED 29.9 billion by the end of the quarter.

The Bank’s capital adequacy ratio as per Basel II requirement at the end of the quarter is 24.2% against a current minimum total capital ratio of 12% prescribed by the UAE Central Bank. At the end of the quarter, the regulatory liquid assets ratio (LAR) was 16.6% AED and lending to stable resources ratio (LSRR) was 75.1%. Total shareholder’s equity totaled AED 7.5 billion and includes three months profit for the year 2015 and undistributed dividend of AED 838.1 million for the year 2014.

RAKBANK Concludes Annual General Meeting

٠٨/٠٤/٢٠١٥

Shareholders elect board members and approve 50 fils cash dividend for 2014

Ras Al Khaimah, UAE – 9 April 2015: RAKBANK successfully concluded its Annual General Meeting today at its headquarters in Ras Al Khaimah. During the AGM, shareholders approved the distribution of a cash dividend of 50 percent (50 fils per share) for the financial year ending 31 December 2014.

RAKBANK’s ordinary annual general meeting proceeded to elect the Board of Directors, which welcomed three new members this year. For the financial years 2015-2017, RAKBANK’s Board of Directors consists of:

- H.E. Mohammad Omran Alshamsi

- H.E. Engr. Sheikh Salem Bin Sultan Al Qasimi

- Mr. Ahmed Essa Al Naeem

- Mr. Hamad Abdulaziz Al Sagar

- Mr. Salem Ali Al Sharhan

- Mr. Yousuf Obaid Al Nuaimi

- Mr. Rajan Khetarpal

- Mr. Allan Griffiths

Following the election, the directors met and unanimously elected H.E. Mohammad Omran Alshamsi as the new RAKBANK Chairman. Commenting on his appointment, H.E. Mohammad Omran Alshamsi, former CEO and Chairman of Etisalat, said: “I am pleased to be named Chairman of one of the most dynamic UAE banks. I appreciate the trust and confidence placed in me by the shareholders and my fellow board members.”

From his side, RAKBANK’s CEO, Peter England, said: “I would like to take this opportunity to welcome H.E. Mohammad Omran Alshamsi as the new Chairman and my team and I look forward to his guidance and counsel as we embark on the next phase of the bank’s transformation and growth.

I would also to thank H.E. Sheikh Omar Bin Saqr Al Qasimi for his contribution to the Bank. H.E. Sheikh Omar Bin Saqr Al Qasimi was elected as the Bank’s Chairman in 2006 and has served in this role until today. Under his supervision, the Bank saw its net profit rise from AED 258.8 million in 2006 to AED 1,454.6 million by end of 2014, while assets quadrupled from AED 8.8 billion in 2006 to AED 34.8 billion at the end of last year.”

“In 2014, RAKBANK once again recorded solid top line performance as a result of growth in just about all of our key business lines,” added England. “I look forward to working with our new Board as the Bank continues to explore new opportunities for revenue growth across Retail and Business Banking, while taking advantage of new opportunities that aim to grow our presence in the UAE and increase market share.”

The AGM also approved the financial statements for the year ending December 31, 2014 and the appointment of PricewaterhouseCoopers as the Bank’s external auditors for the financial year 2015.

RAKBANK Sponsors Ras Al Khaimah Student to Participate in Antarctic Expedition

٠٤/٠٤/٢٠١٥

Dubai, UAE: RAKBANK is pleased to announce that as part of its CSR programme for the year, the Bank sponsored Ameera Mohammed Al Haranki, a 22 year old national student from Ras Al Khaimah, to take part in the ‘2041 International Antarctic Expedition 2015’ (IAE 2015). The life-changing expedition consisted of a two-week journey in the island continent involving team-building exercises, talks on climate change and global warming. The delegation of young environmental leaders learned how they can prevent global warming in their respective regions and how they can better incorporate these strategies into their work environments and communities.

Ameera, currently studying IT security at HCT RAK commented: “I’m very interested in environmental conservation and spreading the awareness of how important it is to protect our planet earth. The expedition to Antarctica was an eye-opening experience in terms of shedding light on the repercussions of global warming. This experience will definitely go a long way in helping me pursue a career as an aspiring environmentalist.”

The expedition participants met at the foot of the Andes Mountains in Ushuaia, Argentina and journeyed by ship to the last wilderness on earth, the Antarctic. The 2041 expedition, founded by Robert Swan OBE, the first person in history to walk to both the North and South Poles, annually brings together a group of present and future leaders who want to take responsibility to build resilient communities and seek change for sustainability. They are taught lessons by global experts on today’s issues of climate change and energy use and how they affect us worldwide, along with life lessons on leadership, team building, and unique wildlife experiences.

Sponsoring this expedition is in line with RAKBANK’s commitment to help conserve the environment. The Bank also supports a wildlife research and conservation project in its home emirate of Ras Al Khaimah. Led by Wildlife Consultant Organization, the project consists of wildlife research and public education by a team of veterinarians, biologists, herpetologists and ornithologists, as well as volunteers and university students.

RAKBANK Celebrates 35th Branch Opening in the UAE

٠٢/٠٨/٢٠١٥

New Bank Branch Opened in Al Ras, Dubai

Dubai, UAE - 08 March 2015: RAKBANK recently launched its 35th branch, located in Al Ras near Dubai’s Gold Souk Area. The branch was inaugurated by Peter England, RAKBANK’s CEO, and attended by various members of the senior management team including Ian Hodges, Head of Retail Banking and Emad Hittini, Head of Branches for Southern Emirates.

Peter England remarked that, “RAKBANK’s strategy to ensures that the Bank caters to customers across all the main locations in the UAE especially ones with heavy footfall. The opening of Al Ras branch is in line with the bank’s plan to launch five additional branches in 2015.”

Along with conventional banking products and services, the new branch also offers SME and Trade Finance solutions. With the addition of the Al Ras branch to its network, RAKBANK today serves its customers through a total of 35 branches and over 200 ATMs located across the UAE. For detailed location information when visiting the branches, customers are invited to use the ATM/branch locator found on www.rakbank.ae. Alternatively, customers can enjoy the Bank’s complementing electronic channels for a faster and more convenient banking experience through Online Banking, Mobile Banking, RAKBANK Direct, and Phone Banking.

RAKBANK Ride Raises AED 100,000 for RAK Red Crescent

٢٢/٠٣/٢٠١٥

Ras Al Khaimah, UAE: After the success of the RAKBANK Ride, RAKBANK is pleased to announce that a total of AED 100,000 was raised for Red Crescent in Ras Al Khaimah with the help of 40 participating teams from different companies. The registration fees from the corporate teams, who cycled for 22.8 kilometres in their business attire on al Marjan Island in the Bank’s home emirate, contributed to the pool of donations.

The winning corporate teams had the liberty to decide on the worthy causes to support within Red Crescent, which ranged from medical assistance for hospital patients and financial aid for students, to funding programs for orphans and people with special needs. 50% of the proceeds were allocated by RAKBANK to the Ras Al Khaimah Autism Centre, whereby the remaining 50% was split amongst the winners.

In first place in the corporate ride was Wildlife Middle East, an information resource on the wildlife and environment of the Middle East and surrounding region. They chose to use their 25% prize money to fund rehabilitation programs for children with special needs.

Commenting on behalf of Wildlife ME, Dr. Anne-Lise Chaber said: “We had a great time at the Ride and we credit our win to team effort. Our team was made up of professional and amateur cyclists but together we managed to have the fastest time record!”

Gulf Business Machines, an IT solutions provider, came in second and allocated its 15% earnings to projects aimed at supporting orphans while the third place team, Banyan Tree Al Wadi, a hotel in Ras al Khaimah, gave away its 10% to building wells in places that do not have access to clean water.

With a wide range of worthwhile charitable concerns, Red Crescent supports many humanitarian needs and gives immediate assistance to those in need here in the UAE. RAKBANK visited the centre in the lead up to the RAKBANK Ride and spoke with a man in need, Mr. Ali Al Jaber, who has been receiving donations from Red Crescent Ras Al Khaimah for the past eight years to help him pay for his children’s school fees, rent, electricity, and many other basic necessities of him and his family.

The organisation works closely with private and public schools in the UAE as well as the University of Ras Al Khaimah to offer training and education sessions, so they can understand the organisation better, teaching young children the importance of giving back to one’s community and how they can get involved.

From his side Peter England, RAKBANK CEO, said: “We were pleased to have had over 400 cyclists take part in both the individual and corporate rides in RAKBANK Ride’s first year and we would like to thank all the corporate teams for their contributions to worthy social causes.”

RAKBANK Announces Q1 Winners of its ‘Dream it. Live it.’ Program

١٨/٠٢/٢٠١٥

RAKBANK’s once in a life time ‘Dream it. Live it’ program offers its customers a chance to win all expenses paid packages to some of the world’s greatest sporting events, concerts, family holidays and more. This is the first time that cardholders have the flexibility to choose the event package that they want to win and experience themselves.

Two RAKBANK customers, Asha Makkamalil Kuriakose and Nageswaran Thirugnanam, have recently been announced winners of the all-inclusive couple packages to the Brit Awards 2015 with MasterCard. These are the British music industry's annual pop music awards, and the British equivalent of the American Grammy Awards. The package includes flights and three nights’ accommodation for two guests in London as well as two reception and after party tickets and two Diamond level tickets to the Brit Awards. The winners will be transported to and from the Airport and given a shopping and makeover experience at Harrods plus a complimentary $600 prepaid MasterCard.

Asha Makkamalil Kuriakose, one of the RAKBANK ‘Dream it. Live it’ winner’s comments: ‘London was one of the destinations I had on my wish list. I am truly excited about this amazing prize and would like to give a big thanks to RAKBANK for making my dreams come true! RAKBANK Credit Card rewards are what made this wish a reality, so it goes to show you should swipe when you get a chance, because you never know when you are going to win! I won when I least expected it, and tomorrow you might too!”

Vinod Kumar, another RAKBANK MasterCard Credit Cardholder was one of the five lucky winners who won an all-inclusive couple package to the most coveted title in international cricket. Also during the first quarter draws, 50 lucky winners walked away with tickets to the Jazz Festival in Dubai.

“We have another exciting line-up of sporting and live music events coming up in second quarter including the UEFA Champions League Final 2015 in Berlin. All that the customer needs to do is allocate their accumulated chances from their credit card spends to select the Dream experience that they want to win,” said Banali Malhotra, Head of Marketing at RAKBANK.

Every AED 500 spent on credit cards gives cardholders one chance to enter the quarterly draws, so there is still plenty of time for RAKBANK customers to spend and win. They can then decide to allocate their chances according to the prizes they prefer. Winners will be jetting off to watch the UEFA Champions League Final in June 2015 in Berlin, enjoying a family holiday in Paris, or attending some of the other big and exciting international and local events in the RAKBANK MasterCard Dream it Live it Program.

RAKBANK and Kalyan Jewellers Launch First Goldback Credit Card

٠١/٠٢/٢٠١٥

With vast numbers of people in the UAE choosing to invest in gold and the women here especially loving all things that are shiny and sparkle, RAKBANK has partnered with Kalyan Jewellers to launch a co-branded Credit Card. The RAKBANK KALYAN JEWELLERS MasterCard Credit Card, which is accepted globally for purchases and cash withdrawals, is the first to offer ‘Goldback’. These are loyalty points that are earned at a rate of up to 7% and can be redeemed at any Kalyan Jewellers outlets in the UAE in the form of jewellery. To ensure customer convenience, the card also offers a 0% easy payment plan on diamond and gold jewellery purchases.

“Over the years, the Bank managed to transform the concept of card reward programs in the UAE through a host of unique features including the successful ‘Cashback’ feature,” said Peter England, RAKBANK CEO. “Staying true to the Bank’s prominent position as an innovative and dynamic player, today we are expanding our loyalty program with the RAKBANK KALYAN JEWELLERS Credit Card to offer Goldback and we are pleased to be collaborating with Kalyan Jewellers.”

Kalyan Jewellers is one of the largest jewellery manufacturer distributors in India leveraging its strong roots, of over a century, in the business of textile trading, distribution and wholesaling. Starting with the first jewellery showroom in 1993, today, it has a total of 77 showrooms across India and West Asia, nine out of which are located in the UAE.

Speaking at the launch event, TS Kalyanaraman, Chairman and Managing Director of Kalyan Jewellers said, “We have always been at the forefront when it comes to introducing innovations in the jewellery industry. The RAKBANK Kalyan Jewellers Credit Card is another example of customer-centric innovation wherein customers can harness their retail spends to acquire jewellery with Goldback points. We are delighted to partner with RAKBANK in creating this unique product and enrich customer experience.”

Kalyan Jewellers, one of the largest jewellery manufacturer distributors in India, launched into the GCC region in December 2013. It currently has 9 showrooms in the UAE and 3 in Kuwait. Today, Kalyan Jewellers has a total of 77 showrooms across India.

UAE Corporates Set to Cycle for a Cause at the RAKBANK Ride

RAKBANK is pleased to announce the RAKBANK Ride, a cycling event due to take place on Friday, March 6 2015 in Ras Al Khaimah. The Ride has two categories, a 70- kilometer course for individual cycling enthusiasts and a 22-kilometre course for corporate teams, each of which must comprise of 4 cyclists including at least one senior manager and one female who will all ride in business attire. The top three fastest corporate teams will win the opportunity to donate proceeds from the corporate registration fees to RAK Red Crescent to the cause of their choice.

Recognising growing international biking trends in nations such as the UK, US and Australia, RAKBANK aims to lead the pack in the UAE by supporting the Emirates’ cycling movement. According to the Bank’s recent survey, which was carried out by YouGov and polled 1000 people in the UAE, cycling is the number one pastime activity in the UAE with more than a quarter of respondents choosing to pedal during their free time. A keen cyclist, RAKBANK’s CEO, Peter England, has a vision to get businessmen onto bikes in shirt and tie and encourage the UAE’s corporate and financial community to get moving together.

“Cycling is one of the UAE’s fastest growing sports,” said England. “It promotes a healthy body and healthy mind which increases productivity in the workplace. Set to be an annual fixture, the RAKBANK Ride aims to promote cycling and team spirit, as well as to showcase the Bank’s home emirate of Ras al Khaimah which boasts the most mountainous landscapes in the country.” The emirate is also home to some of the best hotels, one of which is Rixos Bab Al Bahr on Al Marjan Island where the ride will start and finish.

Ahead of the February competition, RAKBANK has identified one of the UAE’s most high profile amateur cycling teams, SWR Team, which is made up of a 30 beginner and experienced cyclists, to spread the message among the cycling community. Founded in September 2013, the team has fielded a squad in every amateur sportive or competition in the UAE and even some abroad in UK, Switzerland, France, Italy and New Zealand.

The Bank is well known for its prolific outdoor advertising and has historically leveraged sports via advertising. By investing in sports sponsorships and events, the Bank seeks to increases brand awareness as it establishes a position with the market segments it targets and represents.

RAKBANK is working with Promoseven Sports to organize the RAKBANK Ride. For more information about the event, registration for corporate teams and individuals, and special rate package rates at Rixos Bab Al Bahr, please click here and follow @RAKBANKride on Instagram and Twitter.

RAKBANK Announces AED 1,454.6 million Net Profit for 2014

٢٦/٠١/٢٠١٥

Ras Al Khaimah, 26 January 2015: RAKBANK today announced AED 1,454.6 million in net profit for the year 2014. Operating profit before provisions increased by 15.7% from the previous year with a strong growth in Total Loans and Advances. Total assets grew by 15.6% compared to the end of 2013 to AED 34.8 billion.

Total operating income went up by AED 404.8 million to AED 3.56 billion as net interest income and net income from Islamic financing grew by 11.8% to AED 2.76 billion. This was due to higher interest income from loans and investments as well as lower cost of deposits. Non-interest income was up by AED 113.1 million as net fees and commission income was bolstered by strong performances in the income streams of Credit Cards, RAKFinance (unsecured lending to small businesses), and Business Banking, in addition to Trade Finance solutions which grew by more than 200% after establishing trade service desks across the UAE.

On the other hand, provisions for loan impairments stood at AED 595.3 million, up by AED 254.7 million over last year due to higher loan provisioning throughout the year. Non-performing loans were steady at 2.4% and net credit losses to average loans and advances closed at 2.5%. The Bank continues to improve its loan loss cover with the loan loss coverage ratio improving to 87.2% compared to 73.3% at the end of 2013, which doesn’t take into consideration mortgaged properties and other realizable asset collateral available against the loans.

Commenting on the Bank’s performance, RAKBANK CEO, Peter England, said: “In 2014 the Bank’s top line performance has been very strong. Our overall income grew by AED 405 million to AED 3.6 billion and our operating profit surpassed the AED 2 billion mark for the first time in the Bank’s history. Our net profit growth however was relatively muted as a result of a full year’s impact of increased provisions. Total loan growth for the year was at 15.4% which reflects well for 2015 as we see the full year impact of the loan growth flowing though into our income lines.”

“In addition to our robust Retail lending performance, our 2014 strategy saw a renewed focus on the SME and commercial banking segment, with the traditional Business Banking portfolio more than doubling from 2013 to reach AED 2.2 billion.” In mid-2014 we also launched Asset Based Finance to our business customers through which the Bank began funding commercial vehicles and equipment. It crossed AED 100 million within six months of its launch. “These initiatives along with exceptional growth in RAKFinance, means our total business loans are now just under AED 8 billion which would make us one of the largest lenders to SMEs in the UAE,” added England.

Also during 2014, the Islamic banking unit - ‘Amal’ - launched Home Finance under the concept of Ijarah, Instant Finance, as well as Rent and Education Finance. By the end of the year, it achieved a solid growth of AED 2.2 billion in its financing portfolio, an increase of close to 200% over the year before.

Operating costs were up by 9.2% over 2013 due to an increase in employment costs in support of business growth as well as an increase in technology investments to enhance customer service. The rise in operating costs remained below the total operating income growth of 12.9% indicating healthy profitability levels with the Bank’s cost to revenue ratio dropping to 42.3% compared to 43.8% in 2013.

Customer deposits grew by AED 6.9% compared to the previous year to AED 24.7 billion and Islamic customer deposits reached AED 2.6 billion by yearend.

The Bank’s Tier 1 ratio as per Basel II after taking into consideration the profit for 2014 and the proposed dividend was 26.5% at yearend compared to 29% at the end of 2013 (against a requirement of 12% set by the UAE Central Bank). The regulatory liquid asset ratio at the end of the year was 20%, compared to 19.8% at the end of 2013, and advances to stable resources ratio stood comfortably at 88.2% compared to 88.1% at the end of 2013.

“While the weakening price of oil could potentially trigger a slowdown in economic growth going forward, as a largely Retail and SME lender we remain confident about our prospects for loan growth in 2015. With solid results for 2014, the Bank continues to be in a strong competitive position to increase activity and market share in the coming year. We plan to explore new opportunities for revenue growth across Retail, Business, and Islamic Banking while enhancing our Remittance services. We will also introduce innovative products and services, strengthen our branch and ATM network across the country, and launch additional digital banking solutions,” concluded England.

Dividend

At the board meeting held on 26 January 2015, the Directors recommended a cash dividend of 50% which will result in 42.4% of net profit being retained within the Bank’s shareholders equity thereby increasing capital and reserves to strengthen the Bank’s overall position and provide support for future growth.

RAKBANK - The UAE Dream

٠٩/١٢/٢٠١٤

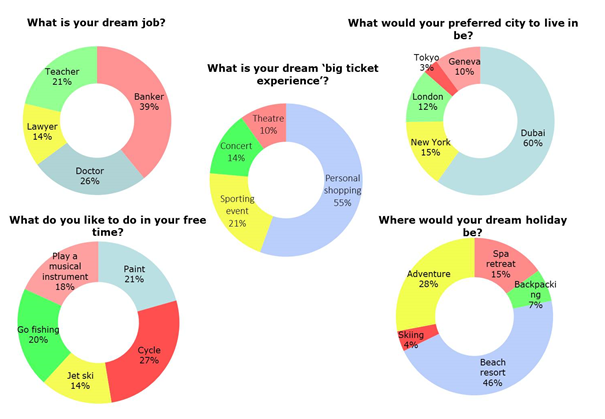

RAKBANK and YouGov Survey on the UAE Dream

From being a banker in Dubai, to spending a holiday at a beach resort and cycling in their free time, people in the UAE share their dreams

- 60% of those polled prefer to live in is Dubai, with New York City as the runner-up

- 40% dream of being a banker, while being a lawyer is the least favourable job

- The dream escape is to spend a holiday at a beach resort

- The ultimate big ticket experience among men and women is personal shopping

- Cycling is the favourite way to spend free time

Dubai, United Arab Emirates, 10 December 2014: RAKBANK is pleased to announce that they have commissioned a survey via an independent research company, YouGov, among a thousand UAE residents to identify the dreams of people in the UAE. With January fast approaching, it is time to be setting goals and deciding which dreams to chase in the New Year. Every great dream begins with a dreamer and for the UAE these dreams are to be a banker by profession, to reside in Dubai, to holiday at a beach resort, to indulge in personal shopping, and to cycle during free time. This survey coincides with the Bank’s recently launched ‘Dream it. Live it’ programme, which gives all RAKBANK MasterCard Credit Card holders the chance to win travel packages to some of the world’s greatest sporting events, concerts, holiday destinations, and more.

London and New York are two cities which often gain the most attention internationally but for people in the UAE Dubai is the number one city to live in with a significant 60% choosing this option. The Big Apple came in second with Westerners favouring the US city most. Dream holidays for people in the UAE are in a beach resort with 46% choosing this relaxing option, but second favourite was an adventure holiday, which 28% of those surveyed selected. For desert dwellers, only 4% of the panel chose an alpine holiday of skiing.

From kindergarten onwards, most of us have a dream job but for the people of the UAE, it is to be a banker, with 40% of people making that choice the majority of which are Asians and Emiratis. The next preferred job is a doctor at 26%, mainly for women and Arab expats, and the least favourable is to be a lawyer.

As for the favourite pass time activity, personal shopping was unsurprisingly top pick in a country that is known for its glamour and vast choice of retail where its population has more disposable income than most. 72% of women opted for the shopping option, with second choice for them choosing the musical experience at 11%. Meanwhile an unexpected 56% of men chose personal shopping and 29% opted for sporting events as their second choice. However, Westerners stood out on this question preferring sporting events to personal shopping.

Cycling, a sport which is very much on the rise in the UAE and which RAKBANK will be supporting next year with a cycling event in February in Ras Al Khaimah, is the UAE’s chosen leisure pursuit, with 27% of men and women enjoying this sporting activity. 29% of men chose cycling while fishing came in second for them as 23% choose to take advantage of the UAE’s perfect coastal location. Women tended to opt for the more creative recreation of painting at 40%, while 20% of women chose cycling as their second choice. Emiratis were the nationality that broke the mould, as they preferred painting, whereas all expat Arabs, Asians, Westerners and other nationalities preferred cycling.

A dream doesn't usually become reality by sheer coincidence; it takes sweat, determination, hard work and hopefully a helping hand from RAKBANK with their latest ‘Dream it. Live it’ programme. Banali Malhotra, Head of Marketing at RAKBANK commented: “We at RAKBANK are hoping we can make people’s dreams come true with this campaign. We have always focused on offering flexible reward programs on our credit cards such as cashback, which gives customers the liberty to choose how they would like to spend their earned cash reward and now we are offering chances to win priceless and memorable experiences.”

With every AED 500 spent on credit cards, cardholders get one chance to enter the quarterly draws. They then decide to allocate their chances according to the prizes they prefer. Winners will be jetting off to the BRIT Awards 2015 in London, watching the UEFA Champions League Final in June 2015 in Berlin, enjoying a family holiday in Paris, or attending some other big and exciting international and local events.

Launch of RAK Startup Weekend

“Startup Weekend” Encourages Entrepreneurial Spirit in Ras Al Khaimah

The global initiative launches a 54-hour-lock-in with creative entrepreneurs and inspiring leaders

November 20, 2014 (RAK, UAE) – Young Arab Leaders- UAE launched the latest in its series of Startup Weekends in the UAE in the emirate of Ras Al Khaimah (RAK). The RAK Startup Weekend brings a local network of passionate leaders and budding entrepreneurs from universities in the northern emirates to share ideas, cultivate concepts, and launch startups. Not only does the initiative inspire students to realize their dreams, start ventures and become future leaders, but it also fosters ongoing relationships between the participants, the successful entrepreneurs, and the global Startup Weekend’s network that reaches over 45,000 alumni members in more than 200 cities.

Startup Weekend welcomes participants to pitch their startup ideas around which teams are organically formed to be followed by a 54-hour frenzy of business model creation, coding, designing, and market validation. The weekends conclude with presentations by the teams in front of local entrepreneurial leaders with an opportunity to receive feedback and guidance. The RAK Weekend brings together some of the UAE’s most powerful and successful businesspeople to serve as speakers, coaches, and judges including Hisham al Gurg, CEO of SEED Group; Najla Al Midfa, Board of Directors at United Arab Bank; Prashant Gulati, Founder of The Smart Start Fund; and Fahad Tawhid, District Manager of RAKBANK; and Khalid al Ameri, Youth Coach and Columnist at The National.

Facilitated in the UAE by Young Arab Leaders-UAE, a non-profit organization that aims at enabling positive change in the Arab world by promoting entrepreneurship, the Startup Weekend aims to inspire, educate and empower individuals, teams and communities. The RAK Startup Weekend is supported by its Platinum Sponsors: Khalifa Fund for Enterprise Development, an independent agency of the Abu Dhabi government that provides venture capital and resources for entrepreneurs, and RAKBANK, or The National Bank of Ras Al Khaimah.

"Young Arab Leaders have previously held Startup Weekends in Dubai and Al Ain,” said Salma Kayali, the Executive Director of YAL in the UAE and lead organizer of the Startup Weekend. “We are excited to bring Startup Weekend to Ras Al Khaimah, and we will continue to support the startup eco-system in the UAE to encourage innovation and promote entrepnreruship."

“Startup Weekend is one of the important events that can encourage innovation and creativity among the youths, and stimulate their entrepreneurship spirit which meets the objectives of Khalifa Fund for Enterprise Development”, said Mouza Obaid Al Naseri the Acting Chief Operations Officer in Khalifa Fund.

“Khalifa Fund is very keen to support such initiatives, the Fund has launched several programs that aim to encourage the youth to adopt innovation and creativity as an approach when establishing their businesses”, added Al Naseri.

From his side, Fahad Tawheed, District Manager at RAKBANK, said: “RAKBANK is pleased to be involved in a great initiative that encourages entrepreneurial spirit among the youth. As a national bank, we are committed to supporting entrepreneurs in the emirate and beyond and catering to their banking needs.”

Other supporters of the Startup Weekend event include: Telr/Innovate Payments, Elevision, In5 the incubator in DIC, Ayman Itani, Potential, Oasis500, Double Tree Hotel in RAK, Silicon Oasis Founder, Stationary.ae, Microsoft, Wamda, Al Eqtisadi, Car Pool Arabia, and White Payments. The media supporter of Young Arab Leaders- UAE: Entrepreneur Middle East Magazine.

To register for the Startup Weekend in the UAE, register at: http://www.up.co/communities/united-arab-emirates/rak/startup-weekend/3639.

RAKBANK Reports AED 1.1 billion in Net Profit for the First Nine Months of 2014 on the Back of a Rise in Operating Income

٢٢/١٠/٢٠١٤

RAKBANK achieved a net profit of AED 1.1 billion for the nine months ended 30 September 2014. Total assets stood at AED 34.8 billion, growing 20.5% year-on-year and 15.5% on a year-to-date basis. Gross loans and advances stood at AED 24.9 billion, up 13.5% year-on-year and 11.5% on a year-to-date basis. Gross Islamic financing assets increased by AED 1.7 billion compared to 31 December 2013.

Total operating income for the nine months ended September 2014 was up by AED 291.5 million to AED 2.6 billion, an increase of 12.5% compared to the nine months ended 30 September 2013. This growth was mainly due to an increase of AED 198.9 million in net interest income and income from Islamic financing, and AED 92.6 million in non-interest income, which climbed by 18.3% over the same period last year.

Net interest income plus net profit from Islamic financing for the nine months ended 30 September 2014 grew by 10.9% compared to the nine months ended 30 September 2013 to AED 2.0 billion. This was a result of higher interest income on loans and investments, a reduction in the cost of deposits as the Bank focused on accumulating low cost transaction accounts, and an increase in net income from Islamic financing to AED 109.8 million in line with the growing Islamic finance portfolio launched in 2013.

The nine month profit dropped by AED 64 million over the same period last year due to more normal levels of provisions for bad debts which started from the last quarter in 2013. The total impairment charge for the nine months stood at AED 425.1 million compared to AED 183.1 million for the same period last year. Non-performing loans were steady at 2.3% of the loan portfolio and the annualized net credit losses to average loans and advances closed at 2.4%.

“Given our loan mix, we are now seeing more normal levels of bad debt after a period of abnormally low credit losses last year. However our underlying business is very robust as operating income continues to grow strongly quarter on quarter,” said Peter England, RAKBANK CEO. “In addition to our top line growth in our Personal Banking business, the Business Banking segment, which covers traditional SME and commercial lending, has become a major engine of growth for RAKBANK, with our loan book more than doubling over the previous year to a total of AED 1.8 billion”.

Net profit for the three months ended 30 September 2014 was up by AED 7.2 million over the quarter ended 30 June 2014 to AED 373.1 million which reflects strong earnings contributions from most of the Bank’s business units.

Customer deposits grew by AED 1.6 billion to AED 24.7 billion compared to 31 December 2013. The growth came mainly from a rise of AED 1.9 billion in conventional demand deposits and AED 344 million in savings deposits. Despite a decrease of AED 1.1 billion in conventional time deposits, there was a healthy growth in Islamic deposits of AED 456 million over the first nine months of 2014.

Operating costs increased by 11.2% to AED 1.1 billion compared to the same period last year mainly due to increases in employment costs to support business growth. However, the Bank’s cost-to-revenue ratio during the first nine months of the year inched down to 42.9% from 43.4% during the same period in 2013.

The Bank’s capital adequacy ratio as per Basel II requirement at the end of the quarter is 25.07% comprising entirely of Tier 1 capital. This is against a current minimum total capital ratio of 12% prescribed by the Central Bank in the UAE. At the end of the quarter, the regulatory liquid assets ratio was 21.7% and lending to stable resources ratio was 86.4%. Total shareholder’s equity totalled AED 6.8 billion including nine months profit.

“Looking ahead, we see more potential for growth by diversifying into fee-generating products and growing our commercial lending and treasury segments. We also see a tremendous opportunity for growth by expanding into complementary industries,” added England. In mid-August 2014, the Bank received approval from its shareholders to acquire a majority stake in Ras Al Khaimah National Insurance Company (RAKNIC) at Dh3.64 per share and is currently awaiting regulatory approvals to proceed with the transaction.

The Bank is currently rated by following leading rating agencies. The below ratings have remained unchanged during the current year.

| Rating Agency | Deposits | Financial Strength | Support |

|---|---|---|---|

| Moody’s | Baa1 / P-2 | D+ | - |

| Fitch | BBB+ / F2 | C | 2 |

| Capital Intelligence | A-/ A2 | BBB+ | 2 |

Dream It and Live It with RAKBANK MasterCard® Credit Cards

٣٠/٠٩/٢٠١٤

Win a chance to attend some of the world’s greatest sporting events, concerts, family holidays and more

Dubai, United Arab Emirates, 1st October 2014: Every great dream begins with a dreamer. For UAE residents, it may be to attend the BRIT Awards 2015 in London, catch the year’s most pulsating cricket action at the ODI Cricket, or watch the UEFA Champions League final in June 2015 in Berlin, Germany, enjoy a family holiday in Paris, or even attend the most happening local events. With RAKBANK’s “Dream it. Live it” program, UAE dreamers can now realize their dreams of attending some of the biggest and most exciting local and international events.

The new "Dream it. Live it." program gives all RAKBANK MasterCard Credit Card cardholders (Titanium, Standard, NMC, Geant La Carte and Titanium Business) the chance to win travel packages to some of the world’s greatest sporting events, concerts, family holidays and more. Best of all, cardholders have the flexibility to choose the event package that they want to experience.

With every AED 500 spent on the Credit Cards, cardholders get one chance to enter the quarterly draws. Through a dedicated microsite on the Bank’s website (www.rakbank.ae), cardholders can choose to put all their chances in the draw for one event or split them equally across events at the end of every quarter. In addition to tickets to the event of choice, the rewards consist of exclusive packages for two, including flights and hotel stays for international events. The list of events includes ODI Cricket, The BRIT Awards 2015 in London, The UEFA Champions League Final 2015 in Berlin, T20 Cricket in India, Motor Racing in Singapore, a New Year Experience in New York, a family holiday in Paris, Jazz Festival in Dubai, and many others.

“There’s no other Credit Card program like it,” said Banali Malhotra, Head of Marketing at RAKBANK. “We have always focused on offering flexible reward programs on our Credit Cards such as Cashback which gives customers the liberty to choose how they would like to spend their earned cash reward. Today we’ve extended our Credit Card features with ‘Dream it. Live it.’ to give customers the unique opportunity to choose the draws they would like to enter based on the packages they would like to win, which include trips and tickets to some of the world’s most popular events,” added Malhotra.

“At MasterCard, we are continuously exploring new avenues to offer priceless and memorable experiences to cardholders”, said Eyad Al Kourdi, UAE Country Head, MasterCard. “The ‘Dream it. Live it.’ campaign is a great opportunity for consumers to win unique experiences and we are excited to collaborate with RAKBANK for this campaign.”

In addition to ‘Dream it. Live it.’ and up to 5% cashback, RAKBANK’s Titanium and MasterCard Credit Cards charge no annual fee ever and offer 0% interest on balance transfer for three months.

RAKBANK Titanium Recognized as Best SME Credit Card by MasterCard

٣٠/٠٩/٢٠١٤

Recognized for its level of innovation in the payments space, RAKBANK’s Titanium Business Credit Card recently won the Best Payment Program award for Small to Medium Enterprises (SMEs) in the Middle East, Africa, and South East Asia during MasterCard’s 2014 Innovation Forum held in Singapore.

Designed to offer added convenience, the Titanium Business Credit Card can be used by business customers to make payments instantly and to take advantage of the cash advance facility to meet unexpected business requirements. Cardholders enjoy the flexibility of paying the minimum amount due on their card within 25 days from the statement date and the balance at their convenience. This free-for-life card is ideal for tracking business expenses and making online payments to the government, utility companies, and others.

“Small business customers make up a significant part of the Bank’s customer base, and with their needs getting increasingly sophisticated, we are committed to providing them with faster, simpler and more convenient payment solutions,” said Ian Hodges, Head of Retail Banking at RAKBANK. “In addition to the Titanium Business Credit Card, RAKBANK also extends Online and Mobile Banking to SMEs to ensure convenience with their everyday banking activities as well.”

The MasterCard forum brought together more than 350 participants from the Southeast Asia, Middle East and Africa to discuss the evolving needs of businesses and consumers and to showcase the latest innovations on the payments front.

Apple Pay

Apple Pay