What's the buzz! Keep up with the latest news from RAKBANK.

Q3 2023 Financial Results

24/10/2023

RAKBANK delivers highest ever Net Profit of AED 1.35B for YTD Sep’2023, up 54% year on year

Ras Al Khaimah, United Arab Emirates, 23 October 2023 – The National Bank of Ras Al Khaimah (RAKBANK) today reported its financial results for the first nine months of 2023

Click here to view the full Q3 Financial Results.

Q2 2023 Financial Results

Q1 2023 Financial Results

26/04/2023

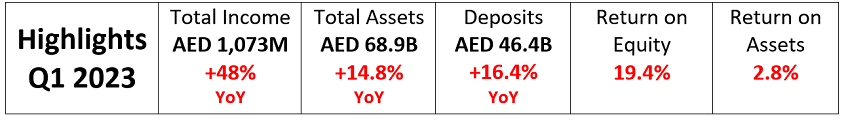

RAKBANK more than doubles its quarterly Net Profit at AED 450M for Q1’23 on the back of strong income growth

Ras Al Khaimah, United Arab Emirates, 26 April 2023 – The National Bank of Ras Al Khaimah (RAKBANK) today reported its financial results for the first quarter of 2023 (“Q1’23”)

RAKBANK delivered a Net Profit increase of 105% for Q1 2023 driven by a robust and diversified growth on both sides of the balance sheet. This was underpinned by strong sales momentum and lower cost of funds.

RAKBANK delivered a Net Profit increase of 105% for Q1 2023 driven by a robust and diversified growth on both sides of the balance sheet. This was underpinned by strong sales momentum and lower cost of funds.

- Total Income performance was supported by a strong net interest income of AED 788.8M, up 46.0% YoY. Net interest margins increased to 4.9% against 3.8% (Q1’22) and continues to be among the highest in the Industry. Q1’23 non-interest income of AED 284.4M, up 52.5% YoY. The growth in non-interest income was driven by higher forex and derivative income.

- Gross loans & advances at AED 38.7B, reflecting a 1.4% increase compared to 31 December 2022 on the back of a changing balance sheet mix in line with the strategic direction of the bank.

- Customer deposits stood at AED 46.4B, an increase of 3.3% compared to 31 December 2022. The Bank has a strong Current & Saving Account (CASA) franchise with the CASA ratio of 70.5%.

- Cost of Risk remained low due to the Bank’s diverse business mix and resilient UAE economic environment, leading to a 30.9% reduction in impairments as against Q4’22. Impaired Loan provision coverage ratio increased to 192.1% against 137.8% in Q1’22, remaining one of the strongest in the industry.

The Bank achieved balanced growth across all Business Segments:

Personal Banking:

- Gross loans & advances at AED 19.1B are up 1% YoY and +2% against FY’22 driven by the sales momentum across products with balance sheet for Auto loans +6%, Mortgages +5% and Personal loans +0.3%.

- Customer deposits of AED 16.7B, are up 22% YoY and +6% during the quarter driven by higher Term deposits +30% & CASA +0.3%.

- Q1’23 income supported by net interest income of AED 229M, +19.0% YoY and non-interest income of AED 123M, +1% YoY.

Business Banking:

- Gross loans & advances of AED 9.3B, are up 12% YoY and +3% against FY’22 mainly through higher volumes for Rak business loans +5%.

- Customer deposits of AED 19.7B, are up 14% YoY and +7% during the quarter driven by higher CASA deposits +7% & Term deposits +2.7%.

- Q1’23 income supported by net interest income of AED 337M, +57.0% YoY and non-interest income of AED 77M +6% YoY.

Wholesale Banking & Others:

- Gross assets (including lending to banks) of AED 19.8B, are up 13% YoY and +1% against FY’22 mainly driven by higher FI bank lending +2%.

- Customer deposits of AED 9.9B, are up 13% YoY and +7% during the quarter.

- Q1’23 income supported by net interest income of AED 224M, +68.0% YoY and non-interest income of AED 84M against a loss of 8Mn in Q1’22.

RAKBANK delivered strong shareholder returns with ROE of 19.4% and ROA of 2.8%, and remained highly liquid and well capitalized.

- The Bank’s Capital Adequacy Ratio (CAR) was at 16.8%.

- The regulatory eligible liquid asset ratio at 14.8%, compared to 12.8% as at 31 December 2022, and the advances to stable resources ratio stood comfortably at 81.8% compared to 79.7% at the end of 2022.

- Cost-income ratio improved to 36.2% driven by strong cost discipline, automation and digitization.

- The Bank’s non-performing loans ratio improved to 3.0% against 3.6% in Q1’22.

Raheel Ahmed, CEO of RAKBANK said, “Delivering on our multi-year strategy, we accelerated our growth and achieved a record net profit of AED 450M and a record total income of AED 1,073M for the quarter. In addition to this impressive growth, I am very pleased with the progress we are making in laying the foundation for sustainable growth.

In diversifying our income sources, we achieved robust growth on both sides of the balance sheet, across interest and fee incomes, and in all our segments. In terms of building deeper customer relationships, we achieved strong growth in digitally active customers with digital transactions growing by 12% YoY. Our high CASA ratio in our deposit base of 70.5% despite the high interest rate environment is a testament of the strong relationships we built with our customers and clients. We enhanced our operational leverage and improved our cost-income ratio through our strong cost discipline, and our cost of risk reduced via diversifying our business mix. The Bank remains well capitalized and liquid with a Capital Adequacy Ratio of 16.8% and an Eligible Liquid Asset Ratio of 14.8%. As a result of our progress, we achieved an ROE of 19.4% and ROA of 2.8%.

Being one of the largest SME banks in the UAE, we continue to back entrepreneurs and start-ups by opening more than 4,000 business accounts in Q1 2023, of which 1,600 accounts were opened for start-ups. Similarly, we disbursed AED 571M in business loans, out of which AED 394M were disbursed for new business loan customers.

As we grow, we are investing heavily in technology while maintaining cost discipline to digitize customer journeys, upgrade core data architecture, and revamp compliance and risk infrastructure. This investment will enable RAKBANK’s journey to provide a superior customer experience that is characterized by its hyper-personalization and relevance. The recent launch of our first fully digital accounts opening capability with straight-through processing is a good example of how we are digitizing our customer journeys.

Continuing from Q4 2022, we are focusing on expanding strategic hires to lead our growth, and we remain committed to and supporting the career aspirations and ambitions of our colleagues. Special attention is drawn to developing our Emirati talents as we align ourselves to the UAE leadership’s mission of growing and nurturing local talent.

As one of the nation’s leading financial institutions, RAKBANK recognizes our responsibility to support the ‘UAE Net Zero by 2050’ initiative. The team is actively engaged with RAK Government on COP28 submissions, working on financial inclusion and reducing emissions. We continue to support financial inclusion and accelerate digital remittances through our wages protection system partner and the United Nations Capital Development Fund.

Lastly, our outlook for FY 2023 remains positive yet cautious, with the buoyant UAE economy and uncertain global macro set up as backdrops. While we closely monitor the headwinds of inflation, rising interest rates, geopolitical developments, we will continue building on the Bank’s strengths and remain committed to delivering on our strategy.”

Financial Highlights for Q1 2023

Profitability Growth supported by Income momentum and improvement in

Provisions

- Net Profit increased by 104.6% to 450.3M (vs Q1’22 104.6% and Q4’22 58.2%).

- Net Interest Income and Income from Islamic products net of distribution to depositors increased by 46.0% to AED 788.8M (vs Q4’22 7.6%).

- Interest income from conventional loans and investments increased by 79.7%, while interest costs on conventional deposits and borrowings increased by 300.5%. Net income from Sharia-compliant Islamic financing increased by 7.8%.

- Non-Interest Income increased by 52.5% to AED 284.8M (vs Q1’22 52.5% and Q4’22 8.7%), primarily due to forex and derivative income booked in Q1 2023.

- Total Income increased by 47.6% (vs Q4’22 7.9%), benefiting from the balance sheet growth momentum.

- Operating Expenditure was AED 389.0M (vs Q1’22 AED 372.4M), reflecting a 4.5% increase compared to the same period in 2022, and a 4.7% increase compared to Q4 2022, due to the Bank's growth investments.

- Operating Expenses increased mainly due to higher staff costs, card expenses, and other operating expenses. However, these were partly offset by lower IT expenses, occupancy costs, depreciation, and communication expenses.

- Cost-to-Income ratio for the bank decreased to 36.2% (vs Q1’22 51.2% and Q4’22 37.3%).

- Provision for credit loss increased by 73.9% to AED 233.9M for Q1 2023 compared to Q1 2022, due to prudent precautionary measures in anticipation of expected developments. However, compared to Q4 2022, the provision for credit loss decreased by 30.9% for Q1 2023.

- Net Credit Losses to average loans and advances closed at 2.5% (vs Q4’22 3.4%).

Balance Sheet crosses AED 68.9B with a strong uptick across all customer segments

- Balance sheet crosses AED 68.9B as the Total Assets increased by AED 2.5B compared to 31 December 2022 reflecting a growth of 3.8%, with an increase in Cash/Central Bank balances by AED 929.2M, Investments by AED 805.8M, Gross Loans and Advances by AED 551.9M and Lending to Banks by AED 480.3M as compared to 31 December 2022.

- Business Banking portfolio increased by AED 264M, Retail Banking by AED 286.2M and Wholesale Banking segment (including bank lending) increased by AED 211M compared to 31 December 2022.

- Business Banking recorded 2.9% growth compared to 31 December 2022 with Business Loans growing by 5.3% and an increase of 1.5% on the Trade and Working Capital Loans portfolio.

- Retail Banking reflected a growth of AED 286.2 M supported by a strong sales momentum across products with Mortgages growing by 4.8% and Auto Loans by 6.4%.

- Non-performing Loans and Advances to Gross Loans and Advances ratio remained same at 3.0% as at 31 March 2023 compared to 31 December 2022.

Robust Growth in Customer Deposits as we continue to be the main bank for most of our customers

- Q1’23 Customer deposits increased by 3.3% compared to 31 December 2022, mainly due to an increase of AED 1,089.5M in CASA deposits and AED 404.7M in time deposits, endorsing the trust our customers place in RAKBANK’s solutions and services. RAKBANK has built a strong CASA franchise with a CASA ratio of 70.5 % as at 31 March 2023.

Strong Capital and Liquidity position

- The Bank’s Capital and Liquidity ratios remained strong.

- With a Total Capital Ratio as per Basel III, after the application of prudential filter, at 16.8% compared to 16.4% at the end of 2022.

- The regulatory eligible liquid asset ratio at the end of 31 March 2023 at 14.8%, compared to 12.8% as at 31 December 2022, and the advances to stable resources ratio stood comfortably at 81.8% compared to 79.7% at the end of 2022.

Healthy Cash Flows from operating activities

- Cash and cash equivalent as at 31 March 2023 were AED 4.7B compared to AED 4.3B as at 31 December 2022.

- Net cash generated from operating activities was AED 1.2B, AED 819.8M was used in investing activities and AED 4.7M used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 37.3M in capital expenditure in Q1 2023.

- RAKBANK will carry on advancing its investment towards customer-centric technology transformation.

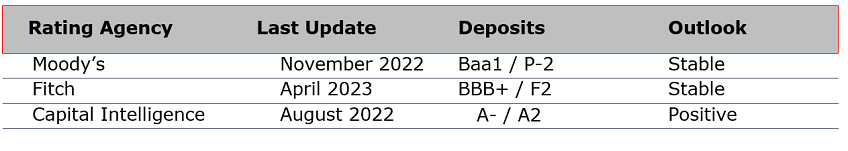

Ratings

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

RAKBANK reports net profit of AED 1,163.4M for 2022

13/02/2023

RAKBANK delivers the highest annual profit growth in over a decade with a Net Profit of AED 1,163.4M and a growth of 53.4% YoY

Highlights Q4/Full Year ended 31 December 2022

Highest net profit growth rate in over a decade. A high single digit income growth supported by robust increases on both sides of the balance sheet.

- FY’22 net profit of AED 1,163.4M, up 53.4% YoY. Q4’22 net profit of AED 284.6M, up 27.3% YoY.

- FY’22 total income of AED 3,451.8M, up 6.9% YOY, with Q4’22 total income of AED 994.8M, up 25.5% YoY.

- Total income for FY’22 was supported by a strong net interest income of AED 2,489.3M, up 14.8% YoY with Q4’22 net interest income of AED 733.1M, up 34.0% YoY. The FY’22 non-interest income was AED 962.5M, lower by 9.4% YoY mainly due to lower trading profits in Q1’22. The non interest income for Q4’22 was AED 261.6M, up 6.7% YoY.

- A well-diversified balance sheet and resilient UAE economic environment led to a 25.3% reduction in impairments as against FY’21. The impairments for Q4’22 reflect an increase of AED 141M against Q4’21 largely on account of prudent management overlays in anticipation of the expected developments in the fast evolving regulatory landscape, uncertain global economy & rising interest rate environment.

- Gross loans & advances at AED 38.1B, reflecting a 7.6% increase YoY on the back of a changing balance sheet mix in line with the strategic direction of the bank.

- Customer deposits stood at AED 44.9B, an increase of 15.3% YoY.

Healthy returns whilst remaining well capitalized and having one of the best provision coverage ratios in the industry.

- The return metrics remained strong with ROA of 1.9% and ROE of 13.5% for FY’22 as against a 1.4% and 9.5% respectively for FY’21.

- The Bank remained well capitalized with a Capital Adequacy Ratio (CAR) of 16.4%.

- Net interest margins increased to 4.1% against 4.0% (FY’21) and continues to be among the highest in the Industry.

- The Bank’s non-performing loans ratio improved to 3.0% against 4.0% for FY’21.

- Impaired Loan provision coverage ratio increased to 181.7% against 133.7% last year, remaining one of the strongest in the industry.

Continued focus on maximizing shareholder returns

- The Board of Directors recommended distribution of a cash dividend of 34 fils per share for the shareholders’ consideration and approval at the Annual General Meeting (AGM).

Just as the UAE economy accelerated its post-COVID recovery in 2022, RAKBANK’s performance has entered a new and transformative era of growth. Following this strong recovery, we are now on track for sustained expansion underpinned by targeted investments and a sharp focus on fiscal and operational resilience.

As a leading financial institution in the UAE, RAKBANK recognizes the important role we play in supporting the country’s vision and growth for the year 2050. We are committed to investing in technology and innovation to drive financial inclusion and create a more diverse and sustainable economy. We understand the importance of supporting the career growth and development of Emiratis and strive to provide them with empowering programs aimed to contribute to their personal growth and that of the UAE economy.

Looking ahead, we foresee 2023 to be a year of opportunity in the midst of uncertainty caused by geopolitical and economic headwinds. Therefore, we will diversify our business mix and further strengthen our credit profile and lay the foundation of a long term, sustainable growth.

Through the execution of our latest multi-year strategic plan, we will build on the Bank’s existing strengths, while continuing to transform the Bank to navigate through a challenging external environment, and ultimately exceed the expectations of our customers.

By accelerating our digital transformation, we will continue to build digital journeys that enable fast, easy, personal, and relevant customer experiences. These outcomes are fundamental to the Bank’s continued success.

RAKBANK delivered a net profit of AED 1,163.4 M, completing a marquee year of recovery and growth with a 53.4% YoY increase – achieving its highest annual growth rate in net profit since 2008. The growth was diversified across all of our segments, and was accompanied by growths in total assets of 15.5%, loans & advances of 7.6%. It is also worth noting that customer deposits grew by 15.3% YoY and CASA ratio was 70.4% as at 31 December 2022 – an important achievement given the rising interest rate environment.

We have seen balance sheet momentum across Wholesale Banking and Business Banking segments that grew by AED 1,589.1M (18.3% YoY) and AED 996M (12.4% YoY) respectively. We also saw Retail Banking grow by AED 102.8M (0.5% YoY).

This stand out performance marks the year of reset.

A reset of performance: where we have achieved a V-shaped recovery by curbing the declines in the pandemic years. We re-ignited growth in both sides of the balance sheet, while prudently managing costs and strengthening our capital position to achieve an ROE of 13.5%.

A reset of strategy: where the Board, the management and employees across the Bank set out our vision to become the ‘digital bank with a human touch with our customers in their key moments of truth’, and defined the strategic programs to achieve that vision.

A reset of the way we work: working as one team, across departments front to back, towards a common goal with clear ownership and accountability.

With the successful completion of the reset phase, now it is time to deliver on the new strategy. We will continue to develop a sustainable business mix including growing the contribution of ‘lower risk’ segments such as Wholesale Banking, Commercial Banking and the Affluent Segment. We will change the way the Bank generates revenue by reducing our reliance on unsecured lending and increasing the proportion of fee and non-financing income as well as driving cross-sell across all segments. Finally, we will create a more scalable business by making investments to enhance our digital journeys and capabilities and improve efficiency in both customer acquisition and servicing.

As we work on these strategic deliverables, we continuously remind ourselves of our north star to stay ahead of the curve in customer experience. We understand that the hallmarks of a superior customer experience are hyper-personalization and relevance, achieved through harnessing the power of data and analytics. To this end, we at RAKBANK will continue to make strides in building trusted partnerships with our customers, as we believe this is ultimately the way we compete - and win.

Financial Highlights for Q4/FY 2022:

*Annualized

**After application of Prudential Filter

Figures in brackets represent unfavorable movements

Key Highlights

Profitability Growth supported by Income momentum and improvement in Provisions

- 53.4% increase in Net Profit to AED 1,163.4M for year ended 31 Dec 2022. Net profit for the quarter at 284.6M up 27.3% compared to Q4 2021.

- Net Interest Income and Income from Islamic products net of distribution to depositors stood at AED 2.5B for year ended 31 Dec 2022, an increase of 14.8% compared to same period in 2021.

- Interest income from conventional loans and investments was up by 26.1% compared to year 2021, and interest costs on conventional deposits and borrowings was up by 109.0%. Net income from Sharia-compliant Islamic financing was up by 5.3%.

- Non-Interest Income at AED 962.5M, reflects a reduction of 9.4% mainly on account of exceptional trading losses that were booked in Q1 2022. Non-Interest Income for Q4 2022 was up 6.7% compared to Q4 2021.

- Non-interest income for year ended 2022 was down by AED 99.6M mainly due to a decrease of AED 72.7M in trading profits, decrease of AED 28.7M in Wealth Management Sales income, decrease of AED 24.2M in Other operating income and a reduction in the Net insurance underwriting profit by AED 31.5M. This was partly offset by an increase of AED 57.6M in Forex and Derivative income.

- Total Income continues to benefit from the momentum attained from the balance sheet achieving a growth of 6.9% as against the previous year and 25.5% increase compared to Q4 2021.

- Operating Expenditure is at AED 1.5B for year ended 31 Dec 2022, reflecting an increase of 6.4% as compared to the same period 2021 and is flat when compared to Q4 2021 as the Bank continued to invest for growth. When measured against the previous quarter, the Operating Expenditure marginally decreased by 0.4%.

- Compared to 31 December 2021, operating expenses for year 2022 were higher mainly due to an increase of AED 75.6M in staff costs, AED 29.6M in Card expenses and AED 6.4M in IT expenses. This was partly offset by a reduction of AED 11.6M in occupancy costs, 8.7M in depreciation and AED 2.7M in marketing expenses.

- Cost-to-Income ratio for the bank decreased to 43.0% compared to 43.2% at the end of last year. As for Q4 2022, the same was at 37.3%, improving against the 40.7% for Q3 2022.

- The Provision for credit loss at AED 804.0M for FY 2022, decreased by 25.3% compared to FY 2021 and is higher by 71.3% for Q4 2022 reflecting an increase of AED 141M against Q4 2021 largely on account of prudent management overlays in anticipation of the expected developments in the fast evolving regulatory landscape, and uncertain global economy & rising interest rate environment.

- Net Credit Losses to average loans and advances closed at 2.1% compared to 3.1% as at 31 December 2021.

Balance Sheet crosses AED 63B with a strong uptick across customer segments

- Balance sheet crosses AED 66.5B as the Total Assets increased by AED 8.9B YoY reflecting a growth of 15.5%, with an increase in Lending to Banks by AED 3.0B, Gross Loans and Advances by AED 2.7B, Investments by AED 2.0B and Cash/Central Bank balances by AED 819.8M as compared to 31 December 2021.

- The Wholesale Banking portfolio increased by AED 1.6B, Business Banking by AED 1.0B and Retail Banking segment increased by AED 102.8M compared to 31 December 2021. Wholesale Banking reflected a strong growth of 27% YoY on the back of a resilient economic environment in the UAE, fueled by the banks strategic balance sheet diversification roadmap.

- Business Banking recorded 12.4% growth YoY with Business Loans growing by 11.4% and an increase of 13.0% on the Trade and Working Capital Loans portfolio.

- Retail Banking reflected a growth of AED 102.8M supported by a strong sales momentum across products with Mortgages growing by 6.2%, Auto Loans by 4.4%, Credit Cards by 3.8% and the balance sheet decline on the Personal Loans front being restricted for FY’22. The overall growth on the Retail Banking was subdued by a drop on loans against investments and other retail loans marred by a rising interest rate environment as compared to 31 December 2021.

- Non-performing Loans and Advances to Gross Loans and Advances ratio declined to 3.0% as at 31 December 2022 compared to 4.0% as at December 2021.

Strong Growth in Customer Deposits as we become the main bank for more of our customers

- Customer deposits increased by 15.3% compared to 31 December 2021, mainly due to an increase of AED 3.7B in time deposits and AED 2.2B in CASA deposits, endorsing the trust our customers place in RAKBANK’s solutions and services. RAKBANK has built a strong CASA franchise with a CASA ratio of 70.4 % as at 31 December 2022.

Comfortable Capital and Liquidity position

- The Bank’s Capital and Liquidity ratios remained strong.

- With a Total Capital Ratio as per Basel III, after the application of prudential filter, at 16.4% compared to 17.0% at the end of 2021.

- The regulatory eligible liquid asset ratio at the end of 31 December 2022 at 12.8%, compared to 11.6% as at 31 December 2021, and the advances to stable resources ratio stood comfortably at 79.7% compared to 82.8% at the end of 2021.

Healthy Cash Flows from operating activities

- Cash and cash equivalent as at 31 December 2022 were AED 4.3B compared to AED 3.3B as at 31 December 2021.

- Net cash generated from operating activities was AED 5.3B, AED 2.6B was used in investing activities and AED 1.7B used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 82.6M in capital expenditure primarily focused on implementing and embedding Consumer Protection Framework while enhancing our AML / CFT systems, and investing in digital experiences.

- RAKBANK will carry on advancing its investment towards customer-centric technology transformation.

2022 was full of developments for RAKBANK and marked by achievements and transformation

- RAKBANK signed a Memorandum of Understanding (MoU) with Tradeling, the hyper growing e-marketplace focused on business-to-business (B2B) transactions in the Middle East and North Africa, to provide enhanced value offering to the Bank’s Business Cardholders.

- RAKBANK announced the launch of a “first of its kind” digital onboarding experience in the region that will enable SMEs to apply for Business Loans, Term and Working Capital Finance and Asset based finance through the Bank’s Quick Apply portal.

- RAKBANK and Abu Dhabi Global Market (ADGM), the international financial center of UAE’s capital, have signed a Memorandum of Understanding (MoU) to provide preferential banking services to ADGM-licensed entities. The agreement facilitates efficient bank account opening for all entities, including SMEs, exchange houses dealing in virtual assets, hedge funds and corporations.

- RAKBANK joined the Arab Monetary Fund (AMF)’s Buna payment platform. This partnership is in line with the Bank’s digital transformation strategy and aims to provide customers with an enhanced payment service platform for sending and receiving cross-border, multicurrency payments safely and securely.

- RAKBANK partnered with global AI Cloud leader, DataRobot and local AI service provider e& enterprise, to build and deploy industry leading AI platform to accelerate its artificial intelligence and machine learning- driven analytics.

- RAKBANK and Honeywell announced a strategic energy saving project to help improve energy efficiencies and carbon reduction goals. Honeywell will optimize heating, ventilation and air conditioning (HVAC), building management system (BMS) and chillers within RAKBANK’s headquarters building, located in Ras Al Khaimah and Dubai, spanning a total area of 19,900sqm.

- RAKBANK teamed up with Etihad Credit Insurance (ECI), the UAE Federal export credit agency, to boost SME financing through the UAE Trade Finance Gateway, a digitized platform that helps exporters and re-exporters based in the country to obtain finance easily and expand their businesses internationally.

Ratings

- RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | November 2022 | Baa1 / P-2 | Stable |

| Fitch | November 2022 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2022 | A- / A2 | Positive |

RAKBANK to accelerate AI strategy in UAE partnering with DataRobot and e&enterprise

15/12/2022

RAKBANK today announced that it has partnered with global AI Cloud leader, DataRobot and local AI service provider e&enterprise, to build and deploy industry leading AI platform to accelerate its artificial intelligence and machine learning- driven analytics.

As RAKBANK progresses its strategic ambition to meet the rapidly evolving customer needs through harnessing the power of data and analytics, a leading AI platform will be an important enabler. DataRobot, with its proprietary approach to MLOps and proven track record serving the majority of the leading financial institutions of the world, will assist in RAKBANK’s analytics and data transformation journey. This partnership also marks the first ever deployment of Data Robot’s AI platform in a financial institution in the region.

Raheel Ahmed, Chief Executive Officer of RAKBANK, said: “RAKBANK’s data and analytics transformation journey will help us engage our current and prospective customers with hyper-personalized and relevant offers and communication. To do this, leveraging AI and Ml tools to maximize the power of data and analytics, and upgrading our capabilities through data democratization and cutting-edge Al platforms will be crucial. We will continue to develop our AI and ML capabilities so that it becomes a key source of the Bank’s competitive advantage.”

Debanjan Saha, Chief Executive Officer of DataRobot, added: “RAKBANK is leading the banking industry with their focus on leveraging AI to optimise many aspects of their business. By choosing the DataRobot AI Cloud Platform and the expertise of the DataRobot team and our strategic partner e& enterprise in the region RAKBANK can further accelerate their AI initiatives and drive transformative change for their organisation. We’re excited to work with such an innovative organisation and look forward to helping them make better, faster, and smarter business decisions guided by AI.”

“At e& enterprise, we are committed to enable industry verticals with AI solutions and services by building a local ecosystem and capabilities. Digital transformation has also accelerated in the banking sector with changing customer demands and the need to create business value. It’s great to collaborate on this project for RAKBANK on its AI adoption journey where they benefit from the digital footprint and managed services expertise of e& enterprise, coupled with DataRobot’s AI platform capabilities” said Alberto Araque, CEO e& enterprise IoT & AI.

DataRobot AI Cloud is one of the most widely deployed AI platforms for end-to-end management of model life cycles. DataRobot brings together diverse data and hundreds of data scientists who continuously develop adaptable models to upgrade all aspects of RAKBANK’s businesses including support of growth agenda, risk management and compliance. DataRobot currently works with 40% of the Fortune 50 companies and their clientele includes 40% of the top global banks.

RAKBANK partners with ADGM to offer dedicated banking services

15/11/2022

RAKBANK and Abu Dhabi Global Market (ADGM), the international financial centre of the capital of the UAE, have signed a Memorandum of Understanding (MoU) to provide preferential banking services to ADGM-licensed entities. The agreement facilitates efficient bank account opening for all entities, including SMEs, exchange houses dealing in virtual assets, hedge funds and corporations.

Under the terms of the MoU, RAKBANK and ADGM will cover a range of service categories including Client Onboarding and Banking, Education and Engagement, Business Development Activities, Employee Banking and Digital Services. Through this agreement, RAKBANK aims to provide banking solutions to SMEs, start-ups, and corporations in sync with their growth objectives and opportunities.

Commenting on this partnership, Raheel Ahmed, CEO of RAKBANK said, “This partnership with ADGM is another step forward in our commitment to support and provide financing solutions to entrepreneurs and businesses in the UAE. RAKBANK is one of the leaders in business banking within the UAE, and this leadership has been built on our ability to create tailored solutions for businesses that drive growth, innovation and employment in the economy. I believe this partnership will equip businesses licensed within ADGM to access cutting-edge and quick banking solutions and services.”

The agreement will pave the way for corporations to capitalise on training and awareness programmes that are jointly provided by RAKBANK and ADGM. Furthermore, the partnership will focus on driving UAE national work placements by providing tailored financial training on SME financing and innovation.

Dhaher bin Dhaher Al Muhairi, CEO of the Registration Authority at ADGM said, “As a catalyst for growth, ADGM aims to develop a robust, business-friendly ecosystem and a regional centre of excellence for fi-nancial services talent development. We are pleased to further our collaboration with RAKBANK to de-velop a range of financial service solutions that support the needs of establishments based within our jurisdiction. We believe that this partnership mirrors the ongoing commitment of both organisations to-ward fostering and developing the finance industry within the emirate of Abu Dhabi and the UAE as a whole. With RAKBANK’s curated propositions, we look forward to strengthening the efficient banking system and providing continued support for the long-term development of the sector in the nation.”

RAKBANK will offer a simplified list of account opening requirements to ADGM licensed entities while also reducing the average turnaround time for operationalizing accounts and securing transaction services. The agreement also covers the provision to offer ADGM incorporated entities to house their USD banking and treasury needs through investment banking services such as structured loans, trade finance, cash management, and supply chain finance.

On the Fintech side, RAKBANK will co-host Digital Labs, Fintech-related events and workshops. Through RAKBANK’s engagement in Fintech Abu Dhabi as part of Abu Dhabi Finance Week and other ADGM Fintech initiatives, the two parties will explore open banking opportunities and develop a Fintech cooperation ecosystem. . RAKBANK will also invest in a dedicated help desk to service the needs of ADGM employees, its subsidiaries, and ADGM incorporated entities. The help desk will be the first touchpoint for all employee banking needs such as providing information, responding to inquiries, receiving complaints, and introducing employees to RAKBANK offers.

RAKBANK reports net profit of AED 878.8mn for the first 9 months of 2022

25/10/2022

RAKBANK reports net profit of AED 878.8mn for the first 9 months of 2022 up 64.4% YoY

Key Highlights Q3/9M ended September 2022

Highest net profit since Q3 2015 driven by diversified balance sheet & lower cost of risk in a robust macro-economic environment.

- Net profit for the quarter amounts to AED 351.4M up 53.7% compared to Q3 2021, reflecting the highest quarterly Net Profit since Q3 2015.

- Compared to Q3 2021, Total Income increased by 13.6% to AED 915.1M, supported by a strong increase of 19.5% for the Net Interest Income to AED 652.8M and an increase of 1.3% of the Non Interest Income to AED 262.3M.

- Gross Loans & Advances totals up to AED 36.0B, showing an increase of 7.5% YoY and 5.3% YTD.

- Customer Deposits stood at AED 40.3B, a boost of 8.8% YoY and 6.9% YTD.

- Well diversified asset growth and continued improvement in the UAE’s economic environment led to a 47.1% YoY reduction in impairments.

Healthy returns whilst remaining well capitalized and having one of the best provision coverage ratios in the industry.

- Net Interest Margins increased marginally to 4.0% and continue to be one of the highest in the Industry.

- The Bank’s Non-Performing Loans ratio is at 3.2% and continues to improve.

- Loan Provision coverage ratio is at 156.5% remaining one of the strongest in the industry.

- Strong profitability metrics with annualized ROA and ROE of 2.0% and 13.9% respectively.

- With Capital Adequacy Ratio (CAR) at 17.0%, the Bank remains well capitalized.

RAKBANK CEO, Raheel Ahmed, commented:

“This quarter we delivered a net profit of AED 351M, which is the highest since Q3 2015, as we continued on our path to sustainable growth & diversified business mix. Our operating Income is becoming well balanced and backed by robust balance sheet growth. We remain disciplined with cost, while reaping the benefits of our business mix shift through lower provisions. The RAKBANK team remains to be fully focused on providing the best service to our customers, while at the same time being relentlessly focused on delivering results.

In order to support the cross border trade and promote strategic initiatives that enhance the region’s payments infrastructure, we have partnered with Buna, the Arab Monetary Fund (AMF)’s payment platform.

We continue to back entrepreneurs and start-ups and opened more than 8,000 new accounts for them YTD. We have also offered financing solutions to more than 3,800 SMEs in the last nine months and helped 800 customers to buy their homes. Additionally we deepened existing relationships as evidenced by the growth in card spends and overall payments.

As a result of our customers’ confidence and trust, we have been recognized as UAE’s Mid-sized Domestic Retail Bank of the Year and UAE’s best SME Bank of the Year by the Asian Banking & Finance Awards. We also received the Best SME Bank in the UAE Award from the Global Finance Magazine and the Banking Excellence Awards.

This quarter’s net profit grew from strength to strength and our 9 months net profit recorded AED 879M, an increase of 64% YoY, as we benefit from income growth and stringent cost management.

Our income growth is driven by the Bank’s solid balance sheet momentum across all the segments, with Business Banking and Wholesale Banking growing by AED 906M (up 11%) and AED 687M (up 8%) respectively, while Retail Banking grew by AED 231M (up 1.3%). Customer Deposits increased by 9% YoY, outpacing the growth in Gross Loans and Advances, given the importance of Liabilities in a rising interest rate environment.

The continuing shift in the business mix to make our business more sustainable and resilient is resulting in the low level of Provision for Credit Loss that recorded AED 465M, marking a 47% decrease YoY.

Lastly, our digital transformation is starting to yield early results as our digitally active customers continued to increase by 7% YoY, while our digital transactions achieved a record growth of over 15% YoY."

Q3/YTD 2022 Management Discussion & Analysis

Financial Highlights for Q3/YTD 2022

Balance Sheet Highlights:

Key Ratios:

*Annualized

**After application of Prudential Filter

Figures in brackets represent unfavorable movements

Key Highlights

Profitability Growth supported by Income momentum and improvement in Provisions

- 64.4% increase in Net Profit to AED 878.8M for nine months ended 30 Sep 2022. Net profit for the quarter at 351.4M up 53.7% compared to Q3 2021, reflecting the highest quarterly Net Profit since Q3 2015.

- Net Interest Income and Income from Islamic products net of distribution to depositors stood at AED 1.8B for nine months ended 30 Sep 2022, an increase of 8.3% compared to same period in 2021.

- Interest income from conventional loans and investments was up by 14.1% compared with the first nine months in 2021, and interest costs on conventional deposits and borrowings was up by 55.6%. Net income from Sharia-compliant Islamic financing was up by 3.7%.

- Non-Interest Income at AED 700.9M, reflects a reduction of 14.2% mainly on account of exceptional trading losses that were booked in Q1 2022. Non-Interest Income for Q3 2022 was up 1.3% compared to Q3 2021.

- Non-interest income was down by AED 116.0M mainly due to a decrease of AED 76.1M in investment income and a reduction in the Gross insurance underwriting profit by AED 21.4M. This was partly offset by an increase of AED 20.0M in Forex and Derivative income.

- Total Income continues to benefit from the momentum attained from the balance sheet achieving a growth of 12.3% as against the previous quarter and 13.6% increase compared to the same quarter previous year.

- Operating Expenditure is at AED 1.1B for nine months ended 30 Sep 2022, reflecting an increase of 8.6% as compared to the same period 2021 and 6.1% when compared to Q3 2021 as the Bank continued to invest for growth. When measured against the previous quarter, the Operating Expenditure marginally increased by 1.4% as we start delivering structured costs to fund our strategic investments.

- Compared to 30 September 2021, operating expenses for first nine months of this year were higher mainly due to an increase of AED 76.1M in staff costs and AED 27.0M in Card expenses. This was partly offset by a reduction of AED 6.5M in depreciation, AED 1.8M in marketing expenses and 6.4M in other expenses.

- Cost-to-Income ratio for the bank increased to 45.3% compared to 42.0% at the end of same period last year and 43.2% for FY 2021 largely due to the losses in the Trading book during the first quarter, leading to lower income for YTD 2022. As for Q3 2022, the same was at 40.7% improving against the 45.1% for Q2 2022.

- The Provision for credit loss at AED 465.3M as at 30 September 2022, decreased by 47.1% compared to same period 2021 and is lower by 15.3% for Q3 2022 when compared to Q3 2021 driven by a change in business mix and improvement in portfolio credit quality.

- Net Credit Losses to average loans and advances closed at 1.7% compared to 3.6% as at end of 30 September 2021.

Balance Sheet crosses AED 63B with a strong uptick across customer segments

- Balance sheet crosses AED 63B as the Total Assets increased year to date by AED 7.5B reflecting a growth of 13.4%, due to an increase in Gross Loans and Advances by AED 1.8B, Cash and Central Bank balance increased by AED 1.9B, an increase in Lending to Banks by AED 2.0B and Investments growth by AED 1.3B.

- A strong balance sheet drive was evident across all of the Bank’s segments. Lending in the Wholesale Banking increased by AED 687.1M, Retail Banking segment increased by AED 231.1M and Business Banking lending increased by AED 905.7M compared to 31 December 2021 respectively.

- Wholesale Banking Segment reflected a strong YTD growth on the balance sheet of 7.9% on the back of strong advancement in the Financial Institutions portfolio.

- The growth of the Retail Banking segment was supported by a strong sales momentum across products, with Mortgages growing by 3.5%, Credit Cards by 3.3%, Auto Loans by 4.0% and Personal Loans by 1.6%.

- Business Banking segment recorded an 11.2% growth YTD backed by a 9.2% increase on Business Loans as well as a raise in the trade and working capital loans by 12.5%.

- Non-performing Loans and Advances to Gross Loans and Advances ratio declined to 3.2% as at 30 September 2022 compared to 4.5% as at 30 September 2021 and 4.1% as at December 2021.

Strong Growth in Customer Deposits as we become the main bank for more of our customers

- Customer deposits increased by 8.8% compared to 30 September 2021 and 6.9% compared to 31 December 2021 mainly due to an increase of AED 1.8B in CASA accounts and AED 759M in time deposits; thus further endorsing the trust our customers place in RAKBANK’s solutions and services.

Comfortable Capital and Liquidity position

- The Bank’s total Capital Ratio as per Basel III, after the application of prudential filter was 17% which remained the same compared to the end of the previous year.

- The regulatory eligible liquid asset ratio at the end of 30 September 2022 was 14.5%, compared to 11.6% as at 31 December 2021, and advances to stable resources ratio stood comfortably at 84.8% compared to 82.9% at the end of 2021.

Healthy Cash Flows from operating activities

- Cash and cash equivalent as at 30 September 2022 were AED 5.1B compared to AED 2.3B as at 30 September 2021.

- Net cash generated from operating activities was AED 4.9B, AED 1.9B was used in investing activities and AED 1.2B used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 58.7M in capital expenditure primarily focused on implementing and embedding Consumer Protection Framework while enhancing our AML / CFT systems, and investing in digital experiences.

- RAKBANK will carry on advancing its investment towards customer-centric technology transformation.

Further embedding ESG into RAKBANK’s Strategy and Mission

- RAKBANK customers logged into our digital solutions over 9 million times in the third quarter of 2022, plus over 250,000 customers are digitally active. This further drives our strategic vision of creating a seamless digital journey for our customers.

- As we continue to be our customers’ long term financial partner and remain by their side through any life changing event, we have introduced RAKBANK Money Assist not only to help them assess their debt situations and make sounder financial decisions but also to support them in planning, spending, and taking control of their finances.

- Moreover, the Bank is working closely with the Ras Al Khaimah Municipality on an energy audit program for the industrial sector. The program will help industrial companies identify energy saving opportunities that will make them more environmentally friendly and competitive. The Bank’s role is to extend a credit facility to dilute these initiatives over time along with any other financial support that such companies may need when investing in the necessary equipment/gear to become energy efficient.

- In 2021, the Bank’s Environmental, Social and Governance (ESG) framework was rated as BBB by Morgan Stanley Capital International (MSCI). For more details on the Bank’s ESG Framework and Approach the Bank urges the public to read the RAKBANK 2021 Annual Integrated Report.

Strategy Going Forward

- RAKBANK has developed a refreshed 5-year strategy to build on the Bank’s existing strengths while creating sustainable growth across all key business lines and delivering a simply better customer experience.

Risk Management in the Current Economic Scenario

- The global economic activity is experiencing an overall slowdown, with inflation growing exponentially. There are plenty of factors that contributed to the situation from the Russian-Ukraine conflict, the effects of COVID-19, Supply-chain challenges, and more.

- According to the IMF, the global growth is forecast to slow from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the aftermath of the COVID-19 pandemic.

- These factors are going to prompt greater caution at the Bank and risk focus as we tread cautiously into the last quarter of 2022 & into 2023.

- The inflation increasing can have a ripple effect on the economy as it directly influences interest rates and borrowing costs. The Bank is looking for methods to offer continuous financial and non-financial support to its customers.

Ratings

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | May 2022 | Baa1 / P-2 | Stable |

| Fitch | April 2022 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2022 | A- / A2 | Positive |

RAKBANK joins cross-border payments platform Buna

04/10/2022

A centralized, risk-controlled, and secure platform providing real-time services to customers

United Arab Emirates, 03 October 2022 – RAKBANK announced that it has joined the Arab Monetary Fund (AMF)’s Buna payment platform today. In line with the Bank’s digital transformation strategy, this partnership aims to provide customers with an enhanced payment service platform for sending and receiving cross-border, multicurrency payments safely and securely.

Buna enables commercial banks, central banks, and other financial institutions, in the Arab region and beyond to send and receive payments in Arab currencies as well as key international currencies. It offers real-time services through a centralized, risk-controlled, and secure platform.

As RAKBANK is a participating Bank in Buna Payments platform, it will now have access to Real time Gross Settlement (RTGS) for foreign remittances offering an efficient, accessible, and risk-controlled payments process to its customers. The main objective is to harness the capabilities of the Buna payment platform to better serve its customers. This partnership will further strengthen the country’s regional cross-border payments sector and provide a seamless payment infrastructure.

Raheel Ahmed, Chief Executive Officer of RAKBANK, said: “Joining the Buna payments platform is a pivotal step in RAKBANK’s plan to support regional cross border trade. It is important for us to explore strategic initiatives that enhance the region’s payments infrastructure. As a customer-focused bank in the UAE, we understand the importance of convenience and speed when it comes to payments. This announcement is in line with our commitment to investing in smarter banking solutions and increasingly using technology to make our range of services more accessible to additional customers, wherever they are. We would like to thank Buna for their exceptional cooperation which has made this process easy and swift.”

Commenting on this, Mehdi Manaa, Chief Executive Officer of Buna, said: ‘’We are pleased to welcome RAKBANK as participant in Buna. With the onboarding of RAKBANK, we look forward to unlocking the opportunities in enhancing cross border payments in multiple Arab and international currencies in compliance with global standards and international best practices. This is a major step to realize our vision to empower economies and strengthen integration within the Arab world. At this occasion, I would also like to thank the Central Bank of UAE for its continuous support to Buna.”

This move comes as the first of many initiatives by the Bank, aimed at enhancing their international payments capabilities. Buna has rapidly grown its network to include over 84 participant banks.

RAKBANK reports net profit of AED 527.4mn in H1 2022

26/07/2022

Key Highlights Q2 / H1 2022

Strong profit growth driven by diversified balance sheet & lower cost of risk in a buoyant macro-economic environment.

- Net profit for the quarter at 307.3 mn up 39.7% compared to Q1 2022, reflecting the highest quarterly Net Profit since 2015.

- Compared to Q1 2022, total Income increased by 12.1% to AED 815 mn during this quarter, supported by a strong increase of 4.2% on the Net Interest Income to AED 563.0 mn and an increase of 35.1% on the Non Interest Income to AED 252.0 mn.

- Gross Loans & Advances at AED 35.8 bn, up 7.8% YoY and 4.7% year-to-date.

- Customer Deposits at AED 39.6 bn, up 6.8% YoY and 5.1% year-to-date.

- Balance sheet crosses the AED 60 bn milestone.

- Well diversified asset growth and continued improvement in the macro-economic environment led to 58.0% YoY reduction in impairments.

Healthy returns whilst remaining well capitalized and having one of the best provision coverage ratios in the industry.

- Net Interest Margins stable at 3.9%, continues to be one of the highest in the Industry.

- Non-Performing Loans ratio at 3.6% continues to improve.

- Loan Provision coverage ratio at 142.1% remains one of the strongest in the industry.

- Solid returns with annualized ROA at 1.9% and annualized ROE at 12.7%.

- With Capital Adequacy Ratio (CAR) at 16.8%, the Bank remains well capitalized.

RAKBANK CEO, Raheel Ahmed, commented:

“RAKBANK continued the momentum in Q1 to deliver a strong set of financial results in Q2, recording a net profit of AED 527 mn for H1 2022. Our return on equity is at 12.7% & we continue to maintain an industry leading provision coverage ratio of 142.1%.

We have seen broad based asset growth (7.8% YOY) across all segments of our business, as part of our diversification strategy. Similarly, we are equally pleased with strong deposit growth (6.8% YoY). We maintained our net interest margins at 3.9%, one of the highest in the industry.

Innovation is in our DNA. To support the UAE’s vision to become a global hub for digital assets, we have partnered with Kraken, a global crypto exchange licensed by ADGM, to soon enable their customers to trade directly between crypto & dirhams through local bank accounts. Similarly, as the “go to” bank for the budding entrepreneurs and the thriving SMEs we offered financing solutions to more than 2,400 small and medium enterprise customers in the last six months. This will not only enable them to launch or grow their businesses, but also contribute to the country’s economic growth. We also partnered with DIFC & a few other banks to launch the region's first Open Finance Lab to promote the development and growth of the UAE financial technology sector.

We continue to accelerate our focus on being trusted advisors to our customers and clients for all their financial needs enabled by digital solutions, personalization (through analytics) & a customer obsessed mind-set and culture. I am pleased to report that we crossed 5Mn digital transactions in H1 of 2022 (up 20% YoY). Customer engagement also continues to strengthen with 26% YoY spend growth on our cards & 6% YoY increase in payments by customers on RAKBANK rails.

In line with the buoyancy in the UAE economy, our outlook for H2 2022 remains positive. However, we continue to carefully monitor the rising interest rates, inflation & the current geopolitical tensions & its potential impact on our customers and clients & supporting them to manage their finances through these uncertain times.”

Financial Highlights for Q2 / H1 2022

Income Statement Highlights:

| Income Statement Highlights | Quarter Results | Half Year Results | ||||||

|---|---|---|---|---|---|---|---|---|

| (AED Mn) | Q2’22 | Q2’21 | Q1’22 | Q2’22 vs Q2’21 | Q2’22 vs Q1’22 | H1 ‘22 | H1 `21 | H1 `22 vs H1' 21 |

| Net Interest Income and net income from Islamic financing | 563.0 | 543.0 | 540.4 | 3.7% | 4.2% | 1,103.4 | 1,074.8 | 2.7% |

| Non-Interest Income | 252.0 | 288.8 | 186.5 | (12.7%) | 35.1% | 438.5 | 557.9 | (21.4%) |

| Total Income | 815.0 | 831.8 | 726.9 | (2.0%) | 12.1% | 1,541.9 | 1,632.7 | (5.6%) |

| Operating Expenditures | (367.7) | (343.1) | (372.4) | (7.2%) | 1.3% | (740.1) | (673.1) | (9.9%) |

| Operating Profit Before Provisions for Impairment | 447.3 | 488.7 | 354.6 | (8.5%) | 26.2% | 801.9 | 959.6 | (16.4%) |

| Provisions for Impairment | (140.0) | (296.6) | (134.5) | 52.8% | (4.1%) | (274.5) | (653.6) | 58.0% |

| Net Profit | 307.3 | 192.1 | 220.1 | 60.0% | 39.7% | 527.4 | 306.0 | 72.4% |

Balance Sheet Highlights:

| Balance Sheet Highlights | Results as at | Variance | |||||

|---|---|---|---|---|---|---|---|

| (AED Bn) | Jun’22 | Mar'22 | Dec'21 | Jun'21 | Jun'22 vs Dec'21 | Jun'22 vs Jun'21 | Jun'22 vs Mar'22 |

| Total Assets | 60.8 | 58.6 | 56.3 | 54.3 | 7.9% | 11.9% | 3.7% |

| Gross Loans & Advances | 35.8 | 35.8 | 34.2 | 33.2 | 4.7% | 7.8% | 0.0% |

| Deposits | 39.6 | 38.5 | 37.6 | 37.0 | 5.1% | 6.8% | 2.9% |

Key Ratios:

| Key Ratios | Quarter Ratios | Half Year Ratios | ||||||

|---|---|---|---|---|---|---|---|---|

| Percentage | Q2'22 | Q2'21 | Q1'22 | Q2'22 vs Q2'21 | Q2'22 vs Q2'22 | H1'22 | H1'21 | H1'22 vs H1'21 |

| Return on Equity | 14.8% | 9.8% | 10.5% | 5.0% | 4.3% | 12.7% | 7.8% | 4.9% |

| Return on Assets | 2.1% | 1.5% | 1.6% | 0.6% | 0.6% | 1.9% | 1.2% | 0.7% |

| Net Interest Margin | 3.9% |

4.2% |

3.9% | (0.3%) | 0.0% | 3.9% | 4.2% | (0.3%) |

| Cost to Income | 45.1% | 41.3% | 51.2% | (3.8%) | 6.1% | 48.0% | 41.2% | (6.8%) |

| Impaired Loan Ratio | 3.6% | 5.1% | 3.7% | 1.5% | 0.1% | 3.6% | 5.1% | 1.5% |

| Impaired Loan Coverage Ratio | 142.1% | 127.7% | 137.8% | 14.4% | 4.3% | 142.1% | 127.7% | 14.4% |

| Basel III Total Capital Adequacy Ratio | 16.8% | 17.8% | 16.5% | (1.0%) | 0.3% | 16.8% | 17.8% | (1.0%) |

*Annualized

**After application of Prudential Filter

Key Highlights

Profitability Growth supported by Income momentum and improvement in Provisions

- 72.4% increase in Net Profit to AED 527.4 mn in H1 2022. Net profit for the quarter at 307.3 mn up 39.7% compared to Q1 2022, reflecting the highest quarterly Net Profit since 2015.

- Net Interest Income and Income from Islamic products net of distribution to depositors at AED 1.1 bn for the first half of 2022 an increase of 2.7% compared to H1 2021.

- Interest income from conventional loans and investments was up by 4.7% compared to H1 2021, and interest costs on conventional deposits and borrowings was up by 14.8%. Net income from Sharia-compliant Islamic financing was down by 0.9%.

- Non-Interest Income at AED 438.5Mn reflects a reduction of 21.4% mainly on account of exceptional trading losses booked in Q1’22.

- Non-interest income was down by AED 119.4 mn mainly due to a decrease of AED 66.7 mn in investment income, decrease of AED 15.9 mn in Forex and Derivative income, decrease of AED 12.5 mn in Net Fee and commission, decrease of AED 11.3 mn in other operating income and Net insurance underwriting profit decreased by AED 13.1 mn.

- Total Income continues to benefit from the momentum attained on the balance sheet with Total Income increasing by 12.1% as against the previous quarter, while the same is lower by 5.6% compared to H1 2021 due to lower Non Interest Income.

- Operating Expenditure at AED 740.1 mn for H1 2022 reflected an increase of 9.9% as compared to H1 2021 and 7.2% as compared to Q2 2021 as the bank continued to invest for growth. Compared to the previous quarter the Operating Expenditure is lower by 1.3% as we start delivering the cost efficiencies to fund our strategic investments.

- Compared to H1 2021, operating expenses for first half of this year were higher mainly due to an increase of AED 45.6 mn in staff costs, AED 20.8 mn in Card expenses, AED 3.1 mn in occupancy costs and 1.5 mn in other expenses. This was partly offset by a reduction of AED 3.8 mn in depreciation and AED 1.1 mn in marketing expenses.

- Cost-to-Income ratio for the bank increased to 48.0% compared to 41.2% at the end of same period last year and 43.2% for FY 2021 largely due to the losses in the Trading book during the first quarter, leading to lower income for H1. As for Q2 2022 the same was at 45.1% improving against the 51.2% for Q1 2022.

- Provision for credit loss at AED 274.5 mn as at H1 2022, decreased by 58.0% compared to H1 2021 and 52.8% compared to Q2 2021 driven by a change in business mix, improvement in portfolio credit quality supported by continued improvement in the macro-economic environment.

- Net Credit Losses to average loans and advances closed at 1.5% compared to 4.0% as at end of first half of 2021.

Balance Sheet crosses AED 60 Bn with a strong uptick across customer segments

- Balance sheet crosses AED 60 bn as the Total Assets increased year to date by AED 4.5 bn reflecting a growth of 7.9%, due to an increase in Gross Loans and Advances by AED 1.6 bn, Cash and Central Bank balance increased by AED 1.3 bn, Lending to Banks which increased by AED 907 mn and Investments increased by 264 mn.

- Lending in the Wholesale Banking increased by AED 754.0 mn, Retail Banking segment increased by AED 339.7 mn and Business Banking lending increased by AED 522.7 mn compared to 31 December 2021. Strong balance sheet momentum was visible across all the segments

- Wholesale Banking Segment reflecting a strong YTD growth on the balance sheet of 8.7% on the back of over 20% growth in the Financial Institutions portfolio

- Growth for Retail Banking supported by a strong sales momentum across products, with Auto loans reflecting 5.1% YTD growth, Mortgages growing by 3.7%, and Credit Cards by 1.2%.

- Business Banking segment recorded a 6.5% growth YTD backed by 4.8% growth on Business Loans while trade and working capital loans reflected 8.9% growth YTD.

- Total Assets increased by AED 6.5 bn to AED 60.8 bn compared to 30 June 2021 mainly due to an increase in Gross Loans and Advances AED 2.6 bn, AED 2.0 bn in Cash and Central bank balances, AED 846 mn in Investments and AED 475 mn in Due from other banks.

- Non-performing Loans and Advances to Gross Loans and Advances ratio was 3.6% as at 30 June 2022 compared to 5.1% as at 30 June 2021 and 4.1% as at December 2021.

Strong Growth in Customer Deposits as we become the main bank for more of our customers

- Customer deposits increased by 6.8% as against first half of 2021 and 5.1% or AED 1.9 bn to AED 39.6 bn compared to 31 December 2021 mainly due to increase of AED 1.3 bn in time deposits and AED 624.4 mn in CASA accounts endorsing the trust our customers place in the RAKBANK franchise and our services.

Capital and Liquidity

- The Bank’s total Capital Ratio as per Basel III, after the application of prudential filter was 16.8% compared to 17.0% at the end of the previous year.

- The regulatory eligible liquid asset ratio at the end of the first half was 13.0%, compared to 11.6% as at 31 December 2021, and advances to stable resources ratio stood comfortably at 82.0% compared to 82.9% at the end of 2021.

Cash Flows

- Cash and cash equivalent as at 30 June 2022 were AED 4.3 bn compared to AED 2.8 bn as at 30 June 2021.

- Net cash generated from operating activities was AED 2.9 bn, AED 720.2 mn was used in investing activities and AED 1.2 bn used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 31.9 mn in capital expenditure primarily focused on implementing and embedding Consumer Protection Framework while enhancing our AML / CFT systems.

- The Bank will continue to invest in innovative digital first technological solutions to offer a highly personalized & digitized experience for our customers.

Further embedding ESG into RAKBANK’s Strategy and Mission

- Over 2.6 mn digital transactions were conducted in the second quarter of 2022.

- Based on results compounded from customer surveys the Net promoter Score of the Bank for Q2’22 improved to 51 and is above the UAE market benchmark.

- In line with the Bank’s ESG Framework, we supported budding entrepreneurs and the thriving SME sector by offering financing solutions to more than 2,400 small and medium enterprises customer throughout the last six months, that will not only enable them to develop their businesses, but also contribute to the economic growth of the UAE.

- During Ramadan, RAKBANK supported Al Jalila Foundation’s campaign called basma. This campaign was an event for all the women who survived/fighting cancer to a wholesome iftar whereby 100% of the proceeds from basma campaign was used to support pioneering childhood cancer research and help children with cancer whose families are unable to afford quality treatment.

- RAKBANK and Edenred’s collaboration with United Nations Capital Development Fund (UNCDF) aims to improve access, uptake, and usage of the Bank’s digital remittance solutions, RAKMoneyTransfer (RMT), among the 1.3 million blue collared migrant workers receiving their wages digitally (C3 cardholders). In addition to the fully digital solution RMT, the Edenred C3 card offers users flexibility with their finances, including access to micro credit facilities, mobile top ups, etc. and is designed to support financial inclusion for the unbanked section of the society.

- The Bank continues to raise awareness about the evolving tax system here in the UAE by inviting over 800 Business Banking customers to attend a comprehensive webinar on the newly announced Corporate Tax. RAKBANK invited panelists and speakers that comprised of top management from Deloitte and MI Capital, tax industry experts that shared their insight on the United Arab Emirates (UAE) federal Corporate Tax (CT) announcement.

- In 2021, the Bank’s Environmental, Social and Governance (ESG) framework was rated as BBB by Morgan Stanley Capital International (MSCI). For more details on the Bank’s ESG Framework and Approach the Bank urges the public to read the RAKBANK 2021 Annual Integrated Report.

Q2 2022 Major Events and Developments

- RAKBANK is one of the four Banks to partner with DIFC to launch the region's first Open Finance Lab to promote the development and growth of the UAE financial technology sector.

- RAKBANK revamped its Digital Market place for SMEs (SMEsouk) with added features and functionalities such as trade license comparator, business toolkit, Digital onboarding, and more.

Risk Management in the Current Economic Scenario

- The ongoing geopolitical crisis in conjunction with the rising interest rates has and is expected to continue to exert an upward pressure on the prices of the most basic necessities.

- Sharp rise in input costs, as prices for fuel, metals, chemicals etc. remain elevated impacted by the global supply-chain challenges

- These factors are expected to prompt a greater caution and risk aversion as we tread cautiously into the second half of 2022.

Strategy Going Forward

- RAKBANK is refreshing its 5-year strategy which defines the bank’s renewed purpose of ‘Simply Better’ banking by becoming the trusted advisor for its customers & clients for their financial needs.

- We are making rapid process in further strengthening our SME customer experience through the launch of digital onboarding & loan capabilities & diversifying & enhancing our wholesale banking business into a relationship led model.

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | May 2022 | Baa1 / P-2 | Stable |

| Fitch | April 2022 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2021 | A- / A2 | Stable |

RAKBANK and Kraken to Offer UAE's First AED-Denominated Virtual Asset Trading

18/07/2022

RAKBANK will become the first UAE bank to enable Kraken to offer transparent, efficient, dirham-based digital asset trading to their customers, as the UAE takes strides to achieve its vision of becoming a global virtual asset hub.

Abu Dhabi, July 18, 2022 – In line with its commitment to “Simply Better” banking and innovation, RAKBANK and Kraken MENA (Kraken), one of the world’s largest digital asset exchanges, have today announced UAE residents will soon be able to trade virtual assets in AED using their local bank account. As regulated by the Central Bank of UAE, RAKBANK will enable Kraken, which is licensed by Abu Dhabi Global Market (ADGM), to have their UAE-based clients fund their crypto account through local fund transfers from any bank in the UAE. Kraken was the first global exchange to have received a full license to operate a regulated virtual asset exchange platform in the Abu Dhabi Global Market (ADGM).

Currently, UAE residents who trade virtual assets must use banks or foreign correspondents outside the UAE to fund their trading. As a result, they incur high foreign exchange costs and fees, experience long lead times (more than 24 hours) and are subject to overseas-jurisdiction asset governance. Through this innovative solution, UAE residents will be able to fund their account faster and at lesser costs, all while remaining within the UAE’s jurisdiction.

“We are proud to be the first UAE bank to enable Kraken, so that it can offer this solution to its UAE-resident crypto investors. This is another step towards our goal of making banking simpler and easier through innovation,” said Raheel Ahmed, Chief Executive Officer of RAKBANK. “The UAE is emerging as a global hub for the crypto and virtual assets industry. With this breakthrough solution, Kraken’s UAE-based investors will be able to transact in virtual assets transparently and efficiently through an ADGM-regulated crypto exchange that has the ability to convert between AED and crypto through UAE Central Bank-regulated banking channels.”

“We are pleased to support the UAE’s vision of becoming a global hub for virtual assets. We believe this offering will enable a simpler, faster and cheaper solution for UAE residents,” added Raheel.

“Kraken is one of the largest and most trusted virtual asset exchanges in the world,” said Benjamin Ampen, Managing Director for Kraken MENA. “Investors in the UAE will soon be able to directly participate and invest in the crypto market. Our solution is safer, more secure, more efficient and reduces costs. Alongside our partners at RAKBANK and under the pioneering regulatory oversight of the ADGM, we are about to make our vision of AED-denominated crypto trading in the UAE a reality.”

H.E Ahmed Jassim Al Zaabi, Chairman of Abu Dhabi Global Market (ADGM) said, "We congratulate RAKBANK and Kraken on this successful partnership that showcases the thriving virtual asset ecosystem of Abu Dhabi and the trust that financial institutions have in the ADGM’s regulatory framework. Today, as an International Financial Centre, we are the leading jurisdiction in the region for the regulation of virtual asset activities and we strongly believe that this partnership is a step forward that confirms Abu Dhabi’s role as a catalyst for virtual-asset innovation".

RAKBANK’s Net Profit jumps by over 93% in the First Quarter of 2022

26/04/2022

- Q1 2022 net Profit up by AED 106.1 million (93.1%) compared to Q1 2021

- Total Assets increased by AED 2.3 billion year-to-date

- Gross Loans and Advances amounted to AED 35.8 billion as of 31st March 2022, an increase of 4.7% year-to-date

- Customer Deposits increased by AED 811 million year-to-date

United Arab Emirates, 26 April, 2022: The National Bank of Ras Al-Khaimah (“RAKBANK”) has announced a consolidated Net Profit of AED 220.1 million for Q1 2022, an increase of 93.1% compared to the first quarter of 2021. Total Income of AED 726.9 million, decreased by 8.3% compared to the fourth quarter of 2021. As at 31 March 2022, Total Assets stood at AED 58.6 billion, increasing by 10.1% year-on-year and 4.1% year-to-date.

RAKBANK CEO, Raheel Ahmed, commented:

“Our diversification strategy is working well. Q1 2022 net profit at AED 220.1 million is 93.1% higher compared to Q1 2021. We have delivered this very significant increase in net profit by improving our return on equity by 460 basis points to 10.5%, improving our returns on assets to 1.6%, whilst maintaining one of the highest impaired loan coverage ratio in the industry at 138%. We saw a reduction in our non-interest income driven by lower trading forex & derivatives & Investment Incomes. However, we expect that this will not be repeated in subsequent quarters. We have a strong balance sheet momentum across all lines of businesses as is evident from the 9.3% year-on-year growth in gross loans and advances. We have seen over a 20% year-on-year increase in digital engagement with customers & have seen double digit growth in both customer spends & customer payments versus Q1 2021. Continuing our journey of innovation, we launched Digital Lending for SMEs & further enhanced our SMEsouk portal - www.smesouk.com - the one stop digital platform for businesses in the UAE.”

Q1 2022 highlights

- Net Profit increased by AED 106.1 million compared to Q1 2021

- Net Interest Income increased by AED 8.7 million compared to Q1 2021

- Total Assets increased by 10.1% compared to Q1 2021

- Annualised Return on Assets stood at 1.6% and Return on Average Equity at 10.5%

Performance review

Total Assets increased year-to-date by AED 2.3 billion which translates into a growth of 4.1%, due to an increase in Gross Loans and Advances which increased by AED 1.6 billion, Lending to Banks which increased by AED 751 million, offset by a reduction in Cash and Central Bank balances by AED 128 million. Total Assets increased by AED 5.4 billion to AED 58.6 billion compared to 31 March 2021 mainly due to an increase of AED 3.1 billion in Gross Loans and Advances, AED 1.3 billion Due from Banks and AED 850 million in Investments.

Provision for Credit Loss decreased by AED 222.5 million compared to Q1 2021 and by AED 63.2 million compared to Q4 2021. Non-Performing Loans and Advances to Gross Loans and Advances ratio was 3.7% as at 31 March 2022, Net Credit Losses to average Loans and Advances ratio closed at 1.6% compared to 4.5% as at the end of the first quarter of 2021.

On a year-on-year basis, Total Operating Income declined by AED 74.0 million to AED 726.9 million. The Net Interest Income and Net Income from Shariah-Compliant Islamic Financing increased by 1.6% year-on-year largely due to the increase in assets. However, the Non-Interest Income decreased by AED 82.7 million to AED 186.5 million, mainly due to a year-on-year decrease in FOREX and Derivative Income of AED 40.8 million, AED 29.3 million in Investment Income and AED 13.6 million in Other Operating Income. This was partly offset by an increase of AED 2.1 million in Net Insurance Underwriting Profit. The reduction was largely due to one off trading losses in the proprietary book due to a sudden increase in interest rates in Quarter 1 impacting the bond book and certain derivative positions. This was further exacerbated by devaluation in foreign exchange rates in certain currencies due to macroeconomic and geopolitical reasons.

The Bank’s total Capital Ratio as per Basel III, after the application of the prudential filter was 16.5% compared to 17.0% at the end of the previous year. The regulatory eligible Liquid Asset Ratio at the end of the quarter was 11.9%, compared to 11.6% as at 31 December 2021, and Advances to Stable Resources ratio stood comfortably at 87.0% compared to 82.9% at the end of 2021.

Q2 2022 outlook

“The impact of rising interest environment, Russia & Ukraine conflict & increase in inflation will have to be managed carefully. There is also intense competition for talent globally. However the UAE economy continues to grow strongly & there has been a significant improvement in both business & consumer sentiment. At RAKBANK we will continue to rapidly accelerate our focus on delivering personalized & convenient financials solutions for our clients whilst providing brilliant customer experience at all touch points.” said Raheel Ahmed. “We strongly believe that whilst continuing to build secure digital solutions is critical, so is ensuring that our colleagues are always there to support our customers, when needed. We are investing in both to deliver ‘Simply Better’ banking.”

Financial Highlights

Increase in Net Profit by over 93%

Income Statement Highlights

| Quarter Results | Variance | ||||

|---|---|---|---|---|---|

| (AED Mn) | Q1’22 | Q4’21 | Q1’21 | FY ‘21 | FY `20 |

| Net Interest Income and net income from Islamic financing | 540.4 | 547.2 | 531.7 | (1.2%) | 1.6% |

| Non-Interest Income | 186.5 | 245.3 | 269.2 | (24.0%) | (30.7%) |

| Total Income | 726.9 | 792.4 | 800.9 | (8.3%) | (9.2%) |

| Operating Expenditures | (372.4) | (371.1) | (330.0) | (0.3%) | (12.9%) |

| Operating Profit Before Provisions for Impairment | 354.6 | 421.3 | 470.9 | (15.8%) | (24.7%) |

| Provisions for Impairment | (134.5) | (197.7) | (354.0) | 32.0% | 62.3% |

| Net Profit | 220.1 | 223.6 | 113.9 | (1.6%) | 93.1% |

Double Digit Increase in Total Assets

| Results as at | Variance | ||||

|---|---|---|---|---|---|

| (AED Bn) | Mar’22 | Dec'21 | Mar'21 | Mar'22 vs Dec'21 | Mar'22 vs Mar'21 |

| Total Assets | 58.6 | 56.3 | 53.2 | 4.1% | 10.1% |

| Gross Loans & Advances | 35.8 | 34.2 | 32.7 | 4.7% | 9.3% |

| Deposits | 38.5 | 37.6 | 36.5 | 2.2% | 5.4% |

Marked improvement in Return on Equity & Return on Assets

| Results | Variance | ||||

|---|---|---|---|---|---|

| Percentage | Mar’21 | Dec'21 | Mar'21 | Mar'22 vs Dec'21 | Mar'22 vs Mar'21 |

| Return on Equity | 10.5% | 9.5% | 5.9% | 1.0% | 4.6% |

| Return on Assets | 1.6% | 1.4% | 0.9% | 0.2% | 0.7% |

| Net Interest Margin | 3.9% |

4.1% |

4.2% | (0.2%) | (0.3%) |

| Cost to Income | 51.22% | 43.2% | 41.2% | (8.0%) | (10.0%) |

| Impaired Loan Ratio | 3.7% | 4.1% | 5.4% | 0.4% | 1.7% |

| Impaired Loan Coverage Ratio | 137.8% | 133.7% | 125.7% | 4.1% | 12.1% |

| Basel III Total Capital Adequacy Ratio | 16.5% | 17.0% | 18.1% | (0.5%) | (1.6%) |

*Annualized

**After application of Prudential Filter

Lending in Wholesale Banking increased by AED 1.3 billion, Retail Banking segment increased by AED 104 million and Business Banking lending increased by AED 238 million compared to 31 December 2021.

Customer deposits increased by AED 811 million to AED 38.5 billion compared to 31 December 2021 mainly due to increase of AED 322 million in time deposits and AED 489 million in CASA accounts.

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown clearly in the table below. Fitch Ratings recently rated RAKBANK at 'BBB+', with a stable outlook. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | October 2021 | Baa1 / P-2 | Stable |

| Fitch | April 2022 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2021 | A- / A2 | Stable |

RAKBANK’s Environmental, Social and Governance (ESG) framework is currently rated as BBB by Morgan Stanley Capital International (MSCI).

Furthermore, RAKBANK believes that long-term financial growth requires a thorough integration of sustainability with its core business strategy. We intend to consistently improve Environmental, Social and Governance (ESG) practices throughout RAKBANK’s operations. The Bank’s Environmental, Social and Governance (ESG) framework is currently rated as BBB by Morgan Stanley Capital International (MSCI). For more details on the Bank’s ESG Framework and Approach the Bank urges the public to read the RAKBANK 2021 Annual Integrated Report.

RAKBANK launches UAEs first Digital Onboarding Platform for SME Loans

04/04/2022