News Integration

Apr 26, 2023

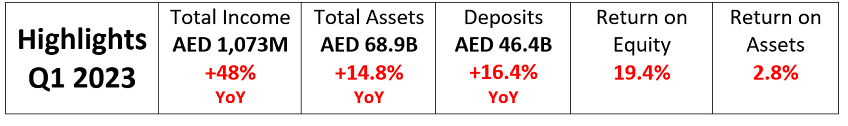

RAKBANK more than doubles its quarterly Net Profit at AED 450M for Q1’23 on the back of strong income growth

RAKBANK more than doubles its quarterly Net Profit at AED 450M for Q1’23 on the back of strong income growth

Ras Al Khaimah, United Arab Emirates, 26 April 2023 – The National Bank of Ras Al Khaimah (RAKBANK) today reported its financial results for the first quarter of 2023 (“Q1’23”)

RAKBANK delivered a Net Profit increase of 105% for Q1 2023 driven by a robust and diversified growth on both sides of the balance sheet. This was underpinned by strong sales momentum and lower cost of funds.

RAKBANK delivered a Net Profit increase of 105% for Q1 2023 driven by a robust and diversified growth on both sides of the balance sheet. This was underpinned by strong sales momentum and lower cost of funds.

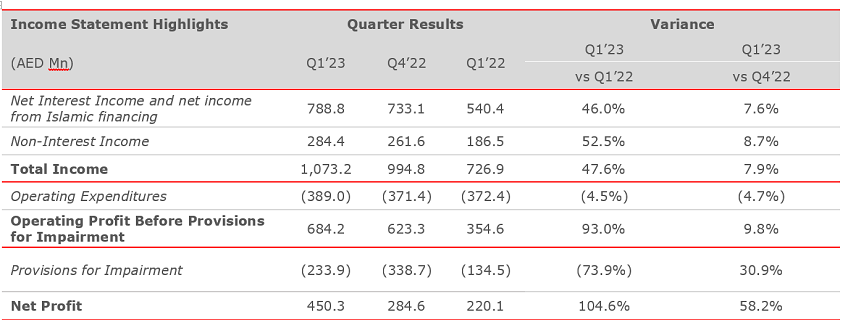

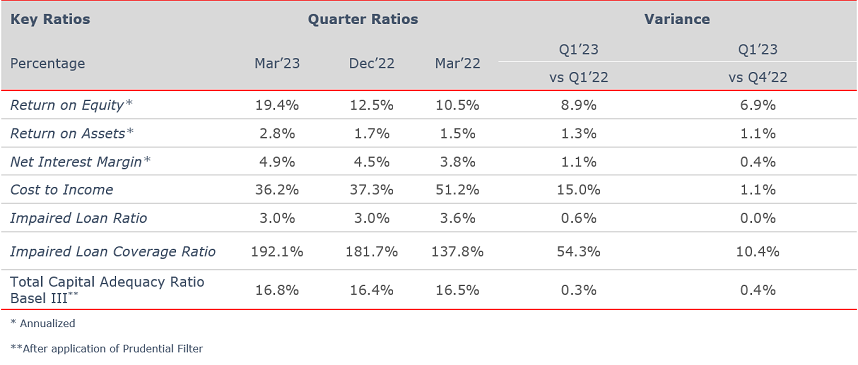

- Total Income performance was supported by a strong net interest income of AED 788.8M, up 46.0% YoY. Net interest margins increased to 4.9% against 3.8% (Q1’22) and continues to be among the highest in the Industry. Q1’23 non-interest income of AED 284.4M, up 52.5% YoY. The growth in non-interest income was driven by higher forex and derivative income.

- Gross loans & advances at AED 38.7B, reflecting a 1.4% increase compared to 31 December 2022 on the back of a changing balance sheet mix in line with the strategic direction of the bank.

- Customer deposits stood at AED 46.4B, an increase of 3.3% compared to 31 December 2022. The Bank has a strong Current & Saving Account (CASA) franchise with the CASA ratio of 70.5%.

- Cost of Risk remained low due to the Bank’s diverse business mix and resilient UAE economic environment, leading to a 30.9% reduction in impairments as against Q4’22. Impaired Loan provision coverage ratio increased to 192.1% against 137.8% in Q1’22, remaining one of the strongest in the industry.

The Bank achieved balanced growth across all Business Segments:

Personal Banking:

- Gross loans & advances at AED 19.1B are up 1% YoY and +2% against FY’22 driven by the sales momentum across products with balance sheet for Auto loans +6%, Mortgages +5% and Personal loans +0.3%.

- Customer deposits of AED 16.7B, are up 22% YoY and +6% during the quarter driven by higher Term deposits +30% & CASA +0.3%.

- Q1’23 income supported by net interest income of AED 229M, +19.0% YoY and non-interest income of AED 123M, +1% YoY.

Business Banking:

- Gross loans & advances of AED 9.3B, are up 12% YoY and +3% against FY’22 mainly through higher volumes for Rak business loans +5%.

- Customer deposits of AED 19.7B, are up 14% YoY and +7% during the quarter driven by higher CASA deposits +7% & Term deposits +2.7%.

- Q1’23 income supported by net interest income of AED 337M, +57.0% YoY and non-interest income of AED 77M +6% YoY.

Wholesale Banking & Others:

- Gross assets (including lending to banks) of AED 19.8B, are up 13% YoY and +1% against FY’22 mainly driven by higher FI bank lending +2%.

- Customer deposits of AED 9.9B, are up 13% YoY and +7% during the quarter.

- Q1’23 income supported by net interest income of AED 224M, +68.0% YoY and non-interest income of AED 84M against a loss of 8Mn in Q1’22.

RAKBANK delivered strong shareholder returns with ROE of 19.4% and ROA of 2.8%, and remained highly liquid and well capitalized.

- The Bank’s Capital Adequacy Ratio (CAR) was at 16.8%.

- The regulatory eligible liquid asset ratio at 14.8%, compared to 12.8% as at 31 December 2022, and the advances to stable resources ratio stood comfortably at 81.8% compared to 79.7% at the end of 2022.

- Cost-income ratio improved to 36.2% driven by strong cost discipline, automation and digitization.

- The Bank’s non-performing loans ratio improved to 3.0% against 3.6% in Q1’22.

Raheel Ahmed, CEO of RAKBANK said, “Delivering on our multi-year strategy, we accelerated our growth and achieved a record net profit of AED 450M and a record total income of AED 1,073M for the quarter. In addition to this impressive growth, I am very pleased with the progress we are making in laying the foundation for sustainable growth.

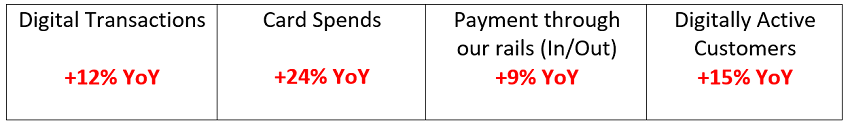

In diversifying our income sources, we achieved robust growth on both sides of the balance sheet, across interest and fee incomes, and in all our segments. In terms of building deeper customer relationships, we achieved strong growth in digitally active customers with digital transactions growing by 12% YoY. Our high CASA ratio in our deposit base of 70.5% despite the high interest rate environment is a testament of the strong relationships we built with our customers and clients. We enhanced our operational leverage and improved our cost-income ratio through our strong cost discipline, and our cost of risk reduced via diversifying our business mix. The Bank remains well capitalized and liquid with a Capital Adequacy Ratio of 16.8% and an Eligible Liquid Asset Ratio of 14.8%. As a result of our progress, we achieved an ROE of 19.4% and ROA of 2.8%.

Being one of the largest SME banks in the UAE, we continue to back entrepreneurs and start-ups by opening more than 4,000 business accounts in Q1 2023, of which 1,600 accounts were opened for start-ups. Similarly, we disbursed AED 571M in business loans, out of which AED 394M were disbursed for new business loan customers.

As we grow, we are investing heavily in technology while maintaining cost discipline to digitize customer journeys, upgrade core data architecture, and revamp compliance and risk infrastructure. This investment will enable RAKBANK’s journey to provide a superior customer experience that is characterized by its hyper-personalization and relevance. The recent launch of our first fully digital accounts opening capability with straight-through processing is a good example of how we are digitizing our customer journeys.

Continuing from Q4 2022, we are focusing on expanding strategic hires to lead our growth, and we remain committed to and supporting the career aspirations and ambitions of our colleagues. Special attention is drawn to developing our Emirati talents as we align ourselves to the UAE leadership’s mission of growing and nurturing local talent.

As one of the nation’s leading financial institutions, RAKBANK recognizes our responsibility to support the ‘UAE Net Zero by 2050’ initiative. The team is actively engaged with RAK Government on COP28 submissions, working on financial inclusion and reducing emissions. We continue to support financial inclusion and accelerate digital remittances through our wages protection system partner and the United Nations Capital Development Fund.

Lastly, our outlook for FY 2023 remains positive yet cautious, with the buoyant UAE economy and uncertain global macro set up as backdrops. While we closely monitor the headwinds of inflation, rising interest rates, geopolitical developments, we will continue building on the Bank’s strengths and remain committed to delivering on our strategy.”

Financial Highlights for Q1 2023

Profitability Growth supported by Income momentum and improvement in

Provisions

- Net Profit increased by 104.6% to 450.3M (vs Q1’22 104.6% and Q4’22 58.2%).

- Net Interest Income and Income from Islamic products net of distribution to depositors increased by 46.0% to AED 788.8M (vs Q4’22 7.6%).

- Interest income from conventional loans and investments increased by 79.7%, while interest costs on conventional deposits and borrowings increased by 300.5%. Net income from Sharia-compliant Islamic financing increased by 7.8%.

- Non-Interest Income increased by 52.5% to AED 284.8M (vs Q1’22 52.5% and Q4’22 8.7%), primarily due to forex and derivative income booked in Q1 2023.

- Total Income increased by 47.6% (vs Q4’22 7.9%), benefiting from the balance sheet growth momentum.

- Operating Expenditure was AED 389.0M (vs Q1’22 AED 372.4M), reflecting a 4.5% increase compared to the same period in 2022, and a 4.7% increase compared to Q4 2022, due to the Bank's growth investments.

- Operating Expenses increased mainly due to higher staff costs, card expenses, and other operating expenses. However, these were partly offset by lower IT expenses, occupancy costs, depreciation, and communication expenses.

- Cost-to-Income ratio for the bank decreased to 36.2% (vs Q1’22 51.2% and Q4’22 37.3%).

- Provision for credit loss increased by 73.9% to AED 233.9M for Q1 2023 compared to Q1 2022, due to prudent precautionary measures in anticipation of expected developments. However, compared to Q4 2022, the provision for credit loss decreased by 30.9% for Q1 2023.

- Net Credit Losses to average loans and advances closed at 2.5% (vs Q4’22 3.4%).

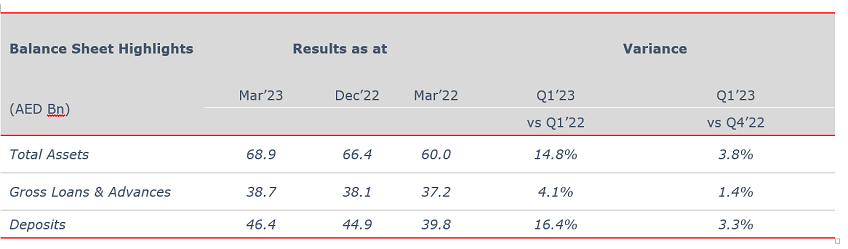

Balance Sheet crosses AED 68.9B with a strong uptick across all customer segments

- Balance sheet crosses AED 68.9B as the Total Assets increased by AED 2.5B compared to 31 December 2022 reflecting a growth of 3.8%, with an increase in Cash/Central Bank balances by AED 929.2M, Investments by AED 805.8M, Gross Loans and Advances by AED 551.9M and Lending to Banks by AED 480.3M as compared to 31 December 2022.

- Business Banking portfolio increased by AED 264M, Retail Banking by AED 286.2M and Wholesale Banking segment (including bank lending) increased by AED 211M compared to 31 December 2022.

- Business Banking recorded 2.9% growth compared to 31 December 2022 with Business Loans growing by 5.3% and an increase of 1.5% on the Trade and Working Capital Loans portfolio.

- Retail Banking reflected a growth of AED 286.2 M supported by a strong sales momentum across products with Mortgages growing by 4.8% and Auto Loans by 6.4%.

- Non-performing Loans and Advances to Gross Loans and Advances ratio remained same at 3.0% as at 31 March 2023 compared to 31 December 2022.

Robust Growth in Customer Deposits as we continue to be the main bank for most of our customers

- Q1’23 Customer deposits increased by 3.3% compared to 31 December 2022, mainly due to an increase of AED 1,089.5M in CASA deposits and AED 404.7M in time deposits, endorsing the trust our customers place in RAKBANK’s solutions and services. RAKBANK has built a strong CASA franchise with a CASA ratio of 70.5 % as at 31 March 2023.

Strong Capital and Liquidity position

- The Bank’s Capital and Liquidity ratios remained strong.

- With a Total Capital Ratio as per Basel III, after the application of prudential filter, at 16.8% compared to 16.4% at the end of 2022.

- The regulatory eligible liquid asset ratio at the end of 31 March 2023 at 14.8%, compared to 12.8% as at 31 December 2022, and the advances to stable resources ratio stood comfortably at 81.8% compared to 79.7% at the end of 2022.

Healthy Cash Flows from operating activities

- Cash and cash equivalent as at 31 March 2023 were AED 4.7B compared to AED 4.3B as at 31 December 2022.

- Net cash generated from operating activities was AED 1.2B, AED 819.8M was used in investing activities and AED 4.7M used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 37.3M in capital expenditure in Q1 2023.

- RAKBANK will carry on advancing its investment towards customer-centric technology transformation.

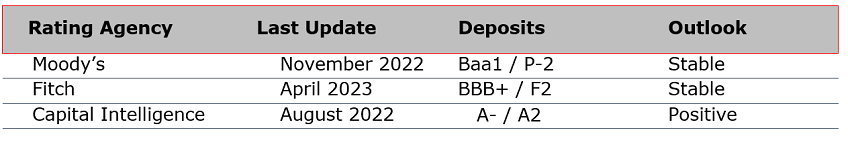

Ratings

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

09 November 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 October 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 September 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 August 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 July 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 June 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 May 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

26 April 2022

RAKBANK’s Net Profit jumps by over 93% in the First Quarter of 2022

- Q1 2022 net Profit up by AED 106.1 million (93.1%) compared to Q1 2021

- Total Assets increased by AED 2.3 billion year-to-date

- Gross Loans and Advances amounted to AED 35.8 billion as of 31st March 2022, an increase of 4.7% year-to-date

- Customer Deposits increased by AED 811 million year-to-date

United Arab Emirates, 26 April, 2022: The National Bank of Ras Al-Khaimah (“RAKBANK”) has announced a consolidated Net Profit of AED 220.1 million for Q1 2022, an increase of 93.1% compared to the first quarter of 2021. Total Income of AED 726.9 million, decreased by 8.3% compared to the fourth quarter of 2021. As at 31 March 2022, Total Assets stood at AED 58.6 billion, increasing by 10.1% year-on-year and 4.1% year-to-date.

RAKBANK CEO, Raheel Ahmed, commented:

“Our diversification strategy is working well. Q1 2022 net profit at AED 220.1 million is 93.1% higher compared to Q1 2021. We have delivered this very significant increase in net profit by improving our return on equity by 460 basis points to 10.5%, improving our returns on assets to 1.6%, whilst maintaining one of the highest impaired loan coverage ratio in the industry at 138%. We saw a reduction in our non-interest income driven by lower trading forex & derivatives & Investment Incomes. However, we expect that this will not be repeated in subsequent quarters. We have a strong balance sheet momentum across all lines of businesses as is evident from the 9.3% year-on-year growth in gross loans and advances. We have seen over a 20% year-on-year increase in digital engagement with customers & have seen double digit growth in both customer spends & customer payments versus Q1 2021. Continuing our journey of innovation, we launched Digital Lending for SMEs & further enhanced our SMEsouk portal - www.smesouk.com - the one stop digital platform for businesses in the UAE.”

Q1 2022 highlights

- Net Profit increased by AED 106.1 million compared to Q1 2021

- Net Interest Income increased by AED 8.7 million compared to Q1 2021

- Total Assets increased by 10.1% compared to Q1 2021

- Annualised Return on Assets stood at 1.6% and Return on Average Equity at 10.5%

Performance review

Total Assets increased year-to-date by AED 2.3 billion which translates into a growth of 4.1%, due to an increase in Gross Loans and Advances which increased by AED 1.6 billion, Lending to Banks which increased by AED 751 million, offset by a reduction in Cash and Central Bank balances by AED 128 million. Total Assets increased by AED 5.4 billion to AED 58.6 billion compared to 31 March 2021 mainly due to an increase of AED 3.1 billion in Gross Loans and Advances, AED 1.3 billion Due from Banks and AED 850 million in Investments.

Provision for Credit Loss decreased by AED 222.5 million compared to Q1 2021 and by AED 63.2 million compared to Q4 2021. Non-Performing Loans and Advances to Gross Loans and Advances ratio was 3.7% as at 31 March 2022, Net Credit Losses to average Loans and Advances ratio closed at 1.6% compared to 4.5% as at the end of the first quarter of 2021.

On a year-on-year basis, Total Operating Income declined by AED 74.0 million to AED 726.9 million. The Net Interest Income and Net Income from Shariah-Compliant Islamic Financing increased by 1.6% year-on-year largely due to the increase in assets. However, the Non-Interest Income decreased by AED 82.7 million to AED 186.5 million, mainly due to a year-on-year decrease in FOREX and Derivative Income of AED 40.8 million, AED 29.3 million in Investment Income and AED 13.6 million in Other Operating Income. This was partly offset by an increase of AED 2.1 million in Net Insurance Underwriting Profit. The reduction was largely due to one off trading losses in the proprietary book due to a sudden increase in interest rates in Quarter 1 impacting the bond book and certain derivative positions. This was further exacerbated by devaluation in foreign exchange rates in certain currencies due to macroeconomic and geopolitical reasons.

The Bank’s total Capital Ratio as per Basel III, after the application of the prudential filter was 16.5% compared to 17.0% at the end of the previous year. The regulatory eligible Liquid Asset Ratio at the end of the quarter was 11.9%, compared to 11.6% as at 31 December 2021, and Advances to Stable Resources ratio stood comfortably at 87.0% compared to 82.9% at the end of 2021.

Q2 2022 outlook

“The impact of rising interest environment, Russia & Ukraine conflict & increase in inflation will have to be managed carefully. There is also intense competition for talent globally. However the UAE economy continues to grow strongly & there has been a significant improvement in both business & consumer sentiment. At RAKBANK we will continue to rapidly accelerate our focus on delivering personalized & convenient financials solutions for our clients whilst providing brilliant customer experience at all touch points.” said Raheel Ahmed. “We strongly believe that whilst continuing to build secure digital solutions is critical, so is ensuring that our colleagues are always there to support our customers, when needed. We are investing in both to deliver ‘Simply Better’ banking.”

Financial Highlights

Increase in Net Profit by over 93%

Income Statement Highlights

| Quarter Results | Variance | ||||

|---|---|---|---|---|---|

| (AED Mn) | Q1’22 | Q4’21 | Q1’21 | FY ‘21 | FY `20 |

| Net Interest Income and net income from Islamic financing | 540.4 | 547.2 | 531.7 | (1.2%) | 1.6% |

| Non-Interest Income | 186.5 | 245.3 | 269.2 | (24.0%) | (30.7%) |

| Total Income | 726.9 | 792.4 | 800.9 | (8.3%) | (9.2%) |

| Operating Expenditures | (372.4) | (371.1) | (330.0) | (0.3%) | (12.9%) |

| Operating Profit Before Provisions for Impairment | 354.6 | 421.3 | 470.9 | (15.8%) | (24.7%) |

| Provisions for Impairment | (134.5) | (197.7) | (354.0) | 32.0% | 62.3% |

| Net Profit | 220.1 | 223.6 | 113.9 | (1.6%) | 93.1% |

Double Digit Increase in Total Assets

| Results as at | Variance | ||||

|---|---|---|---|---|---|

| (AED Bn) | Mar’22 | Dec'21 | Mar'21 | Mar'22 vs Dec'21 | Mar'22 vs Mar'21 |

| Total Assets | 58.6 | 56.3 | 53.2 | 4.1% | 10.1% |

| Gross Loans & Advances | 35.8 | 34.2 | 32.7 | 4.7% | 9.3% |

| Deposits | 38.5 | 37.6 | 36.5 | 2.2% | 5.4% |

Marked improvement in Return on Equity & Return on Assets

| Results | Variance | ||||

|---|---|---|---|---|---|

| Percentage | Mar’21 | Dec'21 | Mar'21 | Mar'22 vs Dec'21 | Mar'22 vs Mar'21 |

| Return on Equity | 10.5% | 9.5% | 5.9% | 1.0% | 4.6% |

| Return on Assets | 1.6% | 1.4% | 0.9% | 0.2% | 0.7% |

| Net Interest Margin | 3.9% |

4.1% |

4.2% | (0.2%) | (0.3%) |

| Cost to Income | 51.22% | 43.2% | 41.2% | (8.0%) | (10.0%) |

| Impaired Loan Ratio | 3.7% | 4.1% | 5.4% | 0.4% | 1.7% |

| Impaired Loan Coverage Ratio | 137.8% | 133.7% | 125.7% | 4.1% | 12.1% |

| Basel III Total Capital Adequacy Ratio | 16.5% | 17.0% | 18.1% | (0.5%) | (1.6%) |

*Annualized

**After application of Prudential Filter

Lending in Wholesale Banking increased by AED 1.3 billion, Retail Banking segment increased by AED 104 million and Business Banking lending increased by AED 238 million compared to 31 December 2021.

Customer deposits increased by AED 811 million to AED 38.5 billion compared to 31 December 2021 mainly due to increase of AED 322 million in time deposits and AED 489 million in CASA accounts.

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown clearly in the table below. Fitch Ratings recently rated RAKBANK at 'BBB+', with a stable outlook. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | October 2021 | Baa1 / P-2 | Stable |

| Fitch | April 2022 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2021 | A- / A2 | Stable |

RAKBANK’s Environmental, Social and Governance (ESG) framework is currently rated as BBB by Morgan Stanley Capital International (MSCI).

Furthermore, RAKBANK believes that long-term financial growth requires a thorough integration of sustainability with its core business strategy. We intend to consistently improve Environmental, Social and Governance (ESG) practices throughout RAKBANK’s operations. The Bank’s Environmental, Social and Governance (ESG) framework is currently rated as BBB by Morgan Stanley Capital International (MSCI). For more details on the Bank’s ESG Framework and Approach the Bank urges the public to read the RAKBANK 2021 Annual Integrated Report.

14 April 2022

Fitch Affirms National Bank of Ras Al-Khaimah at 'BBB+'; Outlook Stable

Fitch Ratings - Dubai - 13 April 2022: Fitch Ratings has affirmed The National Bank of Ras Al-Khaimah (P.S.C)'s (RAKBANK) Long-Term Issuer Default Rating (IDR) at 'BBB+' with a Stable Outlook and Viability Rating (VR) at 'bb'.

For more information, Click here

08 April 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 March 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 February 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that once the Bank receives the Securities and Commodities Authority instructions, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

01 February 2022

RAKBANK Reports Net Profit of AED 758.3 million for 2021

- RAKBANK’s Full-Year 2021 Net Profit increased by AED 252.9 million, a 50% increase over 2020

- The Bank’s Total Assets increased by 6.7% to AED 56.3 billion during 2021

- Gross Loans and Advances amounted to AED 34.2 billion as of 31st December 2021, a year-on-year increase of 6.1%

- The Bank’s Non-Interest Income grew by 2.3% year-on-year

United Arab Emirates, 01 February, 2022: The National Bank of Ras Al-Khaimah (“RAKBANK”) announced a consolidated Net Profit of AED 758.3 million for the Full-Year 2021, resulting in an increase of AED 252.9 million when compared to the previous year. The Bank’s Total Assets amounted to AED 56.3 billion, increasing by 6.7% over 2020. In addition, the Gross Loans and Advances closed at AED 34.2 billion, a year-on-year hike of 6.1%.

Similarly, Customer Deposits grew by 1.9% and this is due to the growth in Time Deposits by 7.4% compared to the previous year, amounting to AED 660.1 million. Similarly, the Return on Average Assets Ratio closed the year at 1.4% compared to 0.9% for the previous year and Return on Average Equity was 9.5%, compared to 6.5% in 2020.

The Board of Directors recommended distribution of a cash dividend of 22.5 fils per share for the shareholders’ consideration and approval at the Annual General Meeting (AGM).

RAKBANK CEO, Peter England, commented: “RAKBANK had a strong finish to 2021, driving Net Profit for the year up to AED 758.3 million. We continue to transform our Bank with a focus on simplification, digitalization and building a culture of excellence. Throughout these past years, we have seen that RAKBANK’s resilience and nimbleness enabled us to offer sound support to our customers throughout the pandemic, with the help of the country’s regulators. Income growth has been a challenge in 2021 as a result of very little business activity during 2020. However, we saw this gradually turn around as the year progressed and the business momentum in the second half of 2021 reflected positively on the Bank’s performance. On Asset Quality, we have seen a significant improvement and our Provisions for 2021 are the lowest they have been in the last 6 years, indicating a strong rebound in the economy and the success of our business diversification strategy that we commenced in 2015.”

FY 2021 highlights

- Net Profit is up 50.0% compared to the previous year.

- Year-on-year increase in the Annualized Return on Assets amounting to 1.4% and Return on Equity to 9.5% respectively for the full year 2021.

- Non-performing Loans and Advances to Gross Loans and Advances Ratio improved to 4.1% as at 31 December 2021.

- Provision Charges for Credit Loss decreased by 35.3% year-on-year.

Performance review

Total Income for the financial year ended 31 December 2021 amounted to AED 3.2 billion, which decreased by 9.4% as compared to the same period of the previous year. Net Interest Income and Net Income from Islamic Finance stood at AED 2.2 billion for the year 2021, decreasing by 14.1% year-on-year. Non-Interest Income increased by AED 23.7 million year-on-year to AED 1.1 billion, mainly due to an increase of AED 54.1 million in Net Fees and Commission Income. Operating Expenses remained the same year-on-year and the Cost to Income Ratio closed at 43.2% for the year.

Gross Loans & Advances increased by AED 2.0 billion to AED 34.2 billion, which is a rise of 6.1% year-on-year resulting in an increase in the Bank’s Total Assets by 6.7% to AED 56.3 billion compared to 31 December 2020. Whereas, Customer Deposits grew by AED 702.8 million to AED 37.6 billion, a 1.9% increase compared to 31 December 2020.

Asset quality

Provision Charges for Credit Loss decreased by AED 586.6 million (FY 2021 Vs FY 2020), which is a 35.3% decrease year-on-year. The Non-Performing Loans and Advances to Gross Loans and Advances Ratio closed at 4.1% for the Full-Year 2021 compared to 5.2% as at 31 December 2020. RAKBANK is well provisioned against Loan Losses with a Loan Loss Coverage Ratio of 133.7%, excluding mortgaged properties and other realizable asset collateral available against loans.

Capitalization and liquidity

The Bank’s Total Capital Adequacy Ratio as per the Central Bank of the UAE regulations and as per Basel III stood at 17.0% at the end of December 2021. The Common Equity Tier 1 ratio of the Bank stood at 15.9%. The Loans to Stable Resources Ratio LSRR as at 31 December 2021, stood at 82.9% compared to 80.7% at the end of 2020, which is significantly lower than the maximum limit of 110%. The regulatory eligible Liquid Asset Ratio of the Group stood at 11.6% at the end of December 2021 compared to 14.5% at the end of 2020, which is well above the minimum requirement and reflects a healthy liquidity position.

RAKBANK’s Chairman, H.E. Mohamed Omran Alshamsi, commented: “RAKBANK’s financial performance this past year yielded tangible results despite the operating environment of 2021. Looking back, during the first half of the year, the UAE economy was recovering from the impacts of COVID-19. However, the second half resulted in a complete turnaround, and this applied to RAKBANK as well. Just as the UAE economy continued to swiftly rebound, RAKBANK has demonstrated a similar form of resilience in 2021 underpinned by the Bank’s diversification strategy. It has become evident that we are well positioned for strong and sustainable growth in the years ahead. Our core business is primed to continue its steady growth on the back of rising Retail and SME activities. Additionally, throughout this past year, RAKBANK focused on investments specifically in digitising the customer journey as we believe that it will drive efficiency and unlock access to attractive new segments. Lastly, I would like to announce that as of February 2nd 2022, Mr Raheel Ahmed will officially assume his responsibilities as the Chief Executive Officer of RAKBANK, as his designated handover period is now complete.”

Financial highlights

Income statement highlights

| Quarter Results | Full Year Results | |||||

|---|---|---|---|---|---|---|

| (AED Mn) | Q4’21 | Q4’20 | Variance% | FY ‘21 | FY `20 | Variance% |

| Net Interest Income and net income from Islamic financing | 547.2 | 561.8 | (2.6%) | 2,168.4 | 2,525.6 | (14.1%) |

| Non-Interest Income | 245.3 | 245.8 | (0.2%) | 1,062.1 | 1,038.4 | 2.3% |

| Total Income | 792.4 | 807.6 | (1.9%) | 3,230.5 | 3,564.0 | (9.4%) |

| Operating Expenditures | (371.1) | (363.7) | (2.0%) | (1,395.6) | (1,395.3) | 0.0% |

| Operating Profit Before Provisions for Impairment | 421.3 | 443.9 | (5.1%) | 1,835.0 | 2,168.7 | (15.4%) |

| Provisions for Impairment | (197.7) | (377.1) | 47.6% | (1,076.7) | (1,663.3) | 35.3% |

| Net Profit | 223.6 | 66.7 | 235.1% | 758.3 | 505.4 | 50.0% |

Balance sheet highlights

| Results as at | Variance | ||||

|---|---|---|---|---|---|

| (AED Bn) | Dec’21 | Sep’21 | Dec’20 | Quarter-on-Quarter | Year-on-Year |

| Total Assets | 56.3 | 54.5 | 52.8 | 3.3% | 6.7% |

| Gross Loans & Advances | 34.2 | 33.5 | 32.2 | 2.1% | 6.1% |

| Deposits | 37.6 | 37.0 | 36.9 | 1.8% | 1.9% |

Key ratios highlights

| Results | Variance | ||||

|---|---|---|---|---|---|

| Percentage | Dec’21 | Sep’21 | Dec’20 | Quarter- on -Quarter | Year-on-Year |

| Return on Equity | 9.5% | 9.0% | 6.5% | 0.5% | 3.0% |

| Return on Assets | 1.4% | 1.4% | 0.9% | 0.0% | 0.5% |

| Net Interest Margin | 4.1% | 4.1% | 4.6% | 0.0% | (0.5%) |

| Cost to Income | 43.2% | 42.0% | 39.2% | (1.2%) | (4.0%) |

| Impaired Loan Ratio | 4.1% | 4.5% | 5.2% | 0.4% | 1.1% |

| Impaired Loan Coverage Ratio | 133.7% | 134.3% | 129.4% | (0.6%) | 4.3% |

| Basel III Total Capital Adequacy Ratio | 17.0% | 17.8% | 18.6% | (0.8%) | (1.6%) |

The Wholesale Banking and Financial Institutions lending was up by AED 1.5 billion compared to 2020 and Personal Banking’s Loan Portfolio also increased by AED 709.9 million. However, the Business Banking Loan Portfolio declined by AED 262.3 million compared to the previous year.

RAKBANK is currently rated by the following leading rating agencies, with their ratings provided below:

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | October 2021 | Baa1 / P-2 | Stable |

| Fitch | December 2021 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2021 | A- / A2 | Stable |

RAKBANK’s Environmental, Social and Governance (ESG) framework is currently rated as BBB by Morgan Stanley Capital International (MSCI).

09 January 2022

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that effective December 31, 2021, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 December 2021

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that effective December 31, 2021, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

29 November 2021

RAKBANK celebrates UAE National Day

United Arab Emirates, 29 November 2021: RAKBANK celebrated the 50th UAE National Day, the Golden Jubilee, at its Ras Al Khaimah headquarters and across the Bank’s 27 branches. Senior management and staff from different nationalities and backgrounds, all gathered to commemorate the 50th National Day by celebrating the UAE’s history, culture, and heritage.

The Golden Jubilee ceremony began with the UAE national anthem, followed by a speech of RAKBANK’s CEO, Peter England, who praised the remarkable journey the UAE has made over the last 50 years and the transformative change that lies ahead in the next 50 years.

The celebration was also marked by a march performed by the Ras Al Khaimah police to commemorate the nation’s spirit of the union, and ended with the Emirati youth standing alongside one another for the traditional Emirati dance, Harbiya.

Furthermore, to honour the UAE’s 50th anniversary RAKBANK launched an exclusive and limited-edition Elite Platinum Debit Cards that offers access to select benefits through elite customers RAKBANK Accounts.

09 November 2021

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that effective December 31, 2021, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

04 November 2021

RAKBANK celebrates UAE Flag Day

RAKBANK marked today the UAE Flag Day with a flag hoisting ceremony at its headquarters in Ras Al Khaimah in the presence of few members of the Bank’s management and employees. As a long standing player in the UAE community, the ceremony was part of RAKBANK’s commitment to commemorate the UAE’s National Flag Day.

31 October 2021

Rating Action: Moody's affirms the ratings of eight UAE banks, changes outlooks to stable from negative

Limassol, October 28, 2021 -- Moody's Investors Service ("Moody's") has today affirmed the long-term ratings of eight United Arab Emirates (UAE)-based banks: Abu Dhabi Commercial Bank (ADCB), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai PSC (CBD), Dubai Islamic Bank PJSC (DIB), HSBC Bank Middle East Limited (HBME), MashreqBank psc (Mashreq), National Bank of Fujairah PJSC (NBF) and The National Bank of Ras-Al-Khaimah (P.S.C.) (RAK). Moody's has also affirmed the Baseline Credit Assessments (BCA) and Adjusted BCAs of the eight banks.

At the same time, Moody's has changed the outlook to stable from negative on the long-term deposit and issuer ratings -- where applicable - of the eight banks.

Please click here to view the List of Affected Credit Ratings. This list is an integral part of this Press Release and identifies each affected issuer.

For more information, click here

27 October 2021

RAKBANK Reports Net Profit of AED 534.7 million for Nine Months Ended 30 September 2021

- Net Profit surged by 73.2% compared to the third quarter of 2020; up by 21.9% year-to-date

- Gross loans and advances up by 2.7% to AED 33.5 billion compared with the third quarter of 2020; up by 4.0% year-to-date

- Total deposits stood at AED 37.0 billion, up by 8.1% year-on-year

- Non-interest income up by AED 24.1 million compared to same period last year

- Provisions for the nine months of 2021 dropped by 31.7% year-on-year

United Arab Emirates, 26 October 2021: The National Bank of Ras Al-Khaimah (“RAKBANK”) announced a consolidated Net Profit of AED 534.7 million for the nine-month period ended 30 September 2021, compared to the net profit of AED 438.6 million for the same period last year. The Total Assets equated to AED 54.5 billion as at 30 September 2021, increasing by 4.1% year-on-year and by 3.3% year-to-date.

There are several factors that led to the spike in the Net Profit throughout the year, which include a reduction in the Provisions for Credit Loss along with an increase in Non-Interest Income to AED 258.9 million on the back of a growth in the Net Fee and Commission Income by AED 14.0 million as well as an increase in Other Operating Income by AED 17.5 million.

RAKBANK CEO, Peter England, commented: “We have seen a continual improvement in asset quality at RAKBANK especially in the last 2 quarters, which has led to a significant improvement in profitability. We have already surpassed our full year 2020 profit numbers in the first 3 quarters of this year. The improvement in asset quality has come about due to the change of mix in our loan book, which we have been gradually implementing over the last few years, and also the significant improvement in the macro-economic environment due to the exemplary handling of the COVID-19 pandemic by the Leadership of the UAE. We see these very positive trends continuing into the 4th quarter which will bode well for a strong start to 2022.”

Performance review YTD 2021

Total Income decreased by 11.5% to AED 2,438.1 million, compared to the same period last year, mainly due to a decrease in Net Interest Income and Net Income from Islamic financing by AED 342.5 million on account of the lower mix of high yielding assets. This was partially offset by higher Non-Interest Income of AED 24.1 million.

Net Interest Income and Net Income from Shariah-Compliant Islamic financing weakened by 17.4% year-on-year to AED 1,621.3 million and the Non-Interest Income increased by 3.0% to AED 816.8 million, as a result of the year-on-year increase of AED 34.0 million in Net Fees and Commission Income, AED 14.0 million in Investment Income and AED 19.2 million in Other Operating Income. This was partially offset by lower Forex and Derivative Income by AED 32.0 million and lower Gross Insurance Underwriting Profit by AED 11.1 million.

Asset

Total Assets increased by AED 1.7 billion or 3.3% year to date and by AED 2.2 billion year-on-year mainly due to the increase in Investment Securities by AED 2.1 billion and in gross Customer Loans & Advances increased by AED 884.4 million.

Asset quality

Provisions for Credit Loss decreased by AED 407.2 million year-on-year. The Non-Performing Loans and Advances to Gross Loans and Advances ratio closed at 4.5% compared to 5.2% as at 31 December 2020. Additionally, the annualised Net Credit Losses to Average Loans and Advances ratio closed at 3.6% compared to 4.9% year-to-date through September 2020.

Capitalization and liquidity

The Bank’s Capital Adequacy ratio as per Basel III was 17.8% compared to 18.6% as at the end of the previous year. The Common Equity Tier 1 ratio of the Bank stood at 16.7%. The regulatory eligible Liquid Asset ratio was 10.4% as at the end of September 2021. The Advances to Stable Resources ratio stood comfortably at 83.9%.

“RAKBANK continues to focus very heavily on its digital transformation and we are increasingly focused on delivering simpler and more convenient banking solutions. We are seeing great traction on our ‘Skiply’ app, which is now being used by over 100,000 families in the UAE access 180 educational institutions who don’t even need to be a RAKBANK customer to benefit from the proposition.” said Peter England. “We have also seen great success in our partnership with YAP that has developed a unique app based banking solution that allows new customers to open and operate RAKBANK accounts and benefit from a range of products and services provided by YAP and RAKBANK. This focus on digitalisation, innovation and partnerships will continue to grow and develop strongly in 2022 and beyond.”

Financial highlights

Income statement highlights

| (AED Mn) | Q3’21 | Q2’21 | Q3’20 | YTD’21 | YTD’20 |

|---|---|---|---|---|---|

| Net Interest Income and net income from Islamic financing | 546.5 | 543.0 | 601.1 | 1,621.3 | 1,963.7 |

| Non-Interest Income | 258.9 | 288.8 | 251.4 | 816.8 | 792.7 |

| Total Income | 805.4 | 831.8 | 852.5 | 2,438.1 | 2,756.4 |

| Operating Expenditures | (351.4) | (343.1) | (325.7) | (1,024.5) | (1,031.6) |

| Operating Profit Before Provisions for Impairment | 454.0 | 488.7 | 526.8 | 1,413.6 | 1,724.8 |

| Provisions for Impairment | (225.3) | (296.6) | (394.8) | (878.9) | (1,286.2) |

| Net Profit | 228.7 | 192.1 | 132.0 | 534.7 | 438.6 |

Balance sheet highlights

| (AED Bn) | Sep’21 | Jun’21 | Dec’20 | Sep’20 |

|---|---|---|---|---|

| Total Assets | 54.5 | 54.3 | 52.8 | 52.3 |

| Gross Loans & Advances | 33.5 | 33.2 | 32.2 | 32.6 |

| Deposits | 37.0 | 37.0 | 36.9 | 34.2 |

Key ratios highlights

| Percentage | Sep’21 | Jun’21 | Dec’20 | Sep’20 |

|---|---|---|---|---|

| Return on Equity | 9.0%* | 7.8%* | 6.5% | 7.6%* |

| Return on Assets | 1.4%* | 1.2%* | 0.9% | 1.1%* |

| Net Interest Margin | 4.1%* | 4.2%* | 4.6% | 4.7%* |

| Cost to Income | 42.0% | 41.2% | 39.2% | 37.4% |

| Impaired Loan Ratio | 4.5% | 5.1% | 5.2% | 5.1% |

| Impaired Loan Coverage Ratio | 134.3% | 127.7% | 129.4% | 131.2% |

| Total Capital Adequacy Ratio Basel III ** | 17.8% | 17.8% | 18.6% | 19.4% |

*Annualised

**After application of Prudential Filter

Total Assets increased by AED 1.7 billion to AED 54.5 billion compared to 31 December 2020, mainly due to an increase in Gross Loans and Advances by AED 1.3 billion, Investments by AED 1.7 billion and Due from Banks by AED 1.3 billion offset by a reduction in Cash and Balances from Central Bank of the UAE by AED 2.2 billion. The increase in Loans and Advances compared to 31 December 2020 is due to an increase of AED 568.6 million in Wholesale Banking loans, increase of AED 940.9 million in Retail Banking loans offset by a reduction of AED 234.6 million in Business Banking loans.

Customer Deposits increased by AED 43.5 million to AED 37.0 billion compared to 31 December 2020, mainly due to an increase in Time Deposits of AED 1,026.5 million. This was partly offset by a decrease of AED 982.9 million in CASA accounts.

RAKBANK is currently rated by the following leading rating agencies, with their ratings provided below:

| Rating Agency | Last Update | Deposits | Outlook |

|---|---|---|---|

| Moody’s | July 2021 | Baa1 / P-2 | Negative |

| Fitch | May 2021 | BBB+ / F2 | Stable |

| Capital Intelligence | August 2021 | A- / A2 | Stable |

RAKBANK’s Environmental, Social and Governance (ESG) framework is currently rated as BBB by Morgan Stanley Capital International (MSCI).

07 October 2021

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends:

1. A letter signed by the shareholder or his legal representative addressed to the Bank and which includes a request to issue a cheque or make a bank transfer of the cash dividend amount.

2. Original Emirates ID of the shareholder and a copy thereof or the original passport of the shareholder and a copy thereof.

3. In the case of a general or a special power of attorney from the shareholder to a third party attorney, please provide the original POA duly notarized at the notary public together with a copy thereof, as well as the original Emirates ID of the attorney and a copy thereof or the original passport of the attorney and a copy thereof.

4. An original letter issued by the relevant bank at which a shareholder holds an account confirming the shareholder’s account IBAN number held at that bank, to which the relevant cash dividends are to be transferred.

5. Please contact the Bank’s IR Team (email: [email protected]; phone: +971 4 291 5545) regarding the special requirements which need to be satisfied in case a shareholder resides outside the UAE or in case of deceased shareholders. Please note that these requirements differ from the requirements which relate to shareholders who are residents of the UAE.

Please note that effective December 31, 2021, dividends unclaimed by their beneficiaries will be transferred to the Securities and Commodities Authority, which will be responsible for disbursing the cash dividends to eligible shareholders upon claiming them. The Authority will publish a statement on the Authority and financial markets websites, explaining that it will assume this role and the details of it in due course.

09 September 2021

Announcement Regarding Unclaimed Cash Dividends of Shareholders

Announcement Regarding Unclaimed Cash Dividends of Shareholders of the National Bank of Ras Al Khaimah (P.S.C.) which are held with the Bank in the period prior to March 1, 2015

With reference to the directives issued by the Securities and Commodities Authority regarding unclaimed cash dividends by shareholders of local listed public joint stock companies that are held with these companies in the period prior to March 1, 2015.

The National Bank of Ras Al Khaimah (P.S.C.) (the Bank) invites its shareholders who are entitled for unclaimed cash dividends in the period prior to March 1, 2015, to contact the Bank by phone: +971 4 291 5545 or email: [email protected] to make sure that the shareholder's name exists and is eligible for cash dividends.

In the event that the shareholder is entitled for cash dividends, the following documents should be submitted to the Bank so as to collect the cash dividends: